BCG Annuity Placements

Total five-year transactions over $4.2 billion

“BCG provides an integrated, one-stop solution for plan sponsors looking to address and manage the costs and risks involved in their pension programs.”

– Mike Devlin, Principal,

BCG Pension Risk Consultants | BCG Penbridge

BCG Pension Risk Consultants I BCG Penbridge (BCG) is a leading provider of cost management and de-risking consulting services for defined benefit pension plans.

Company Snapshot

- Founded in 1983

- Long tenured annuity market, actuarial and defined benefit plan specialists

- Helped over 2,500 organizations achieve their pension de-risking goals

- 100% of firm revenue comes from pension risk consulting, comprehensive implementation support and related services

- Headquartered in Boston with satellite offices across the US

- DALBAR Pension Consultant Certification for fiduciary best practices

Unparalleled Information & Consulting

- Independent, unbiased information and advice

- Actionable analysis for ongoing plan management, de-risking and pension risk transfer (PRT)

- Leader in defined benefit plan cost benchmarking, pension risk consulting, annuity placements and full plan terminations

- Implementation of solutions to meet plan objectives through a balanced, well-informed decision-making process

- Support for plan sponsors and their advisor(s) to create a well-coordinated strategy

The BCG Difference

BCG brings a totally unique and unmatched offering to our clients. We help plan sponsors objectively evaluate and implement cost management and de-risking solutions for defined benefit plans.

- De-risking solutions include liability driven investing approaches, annuity purchases for retirees and/or full risk transfer through plan termination, as well as the strategic positioning of plan design & structure for optimal attractiveness to eventual annuity providers.

- BCG specializes in analysis designed to estimate plan termination funding and to identify tranches of participants that may be involved in de-risking actions for a defined benefit plan such as retiree annuity lift-outs and terminated vested lump sum offers.

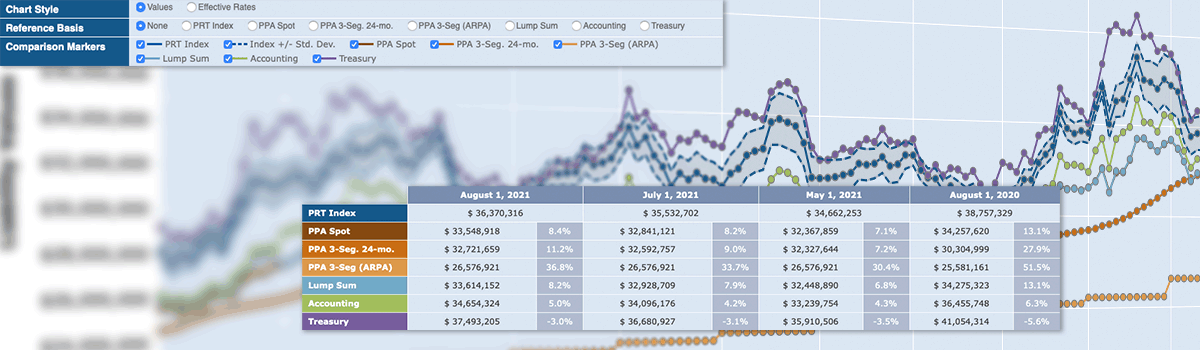

- BCG provides customized buyout price monitoring to plan fiduciaries who are pursuing an LDI strategy that takes into account the future liability obligations of a DB plan, which are reasonably anticipated to include annuity purchases and lump sum payments. CBPM provides DB plans with up-to-date insight on expected liabilities, consults on the de-risking process and timing, in support of investment strategy.

- We work with each plan sponsor client and their advisor(s) to develop a clear, customized path to their desired endgame.

A Deeply Experienced Team

- 28 average years experience in defined benefit and/or annuity placement market for BCG’s senior team members.

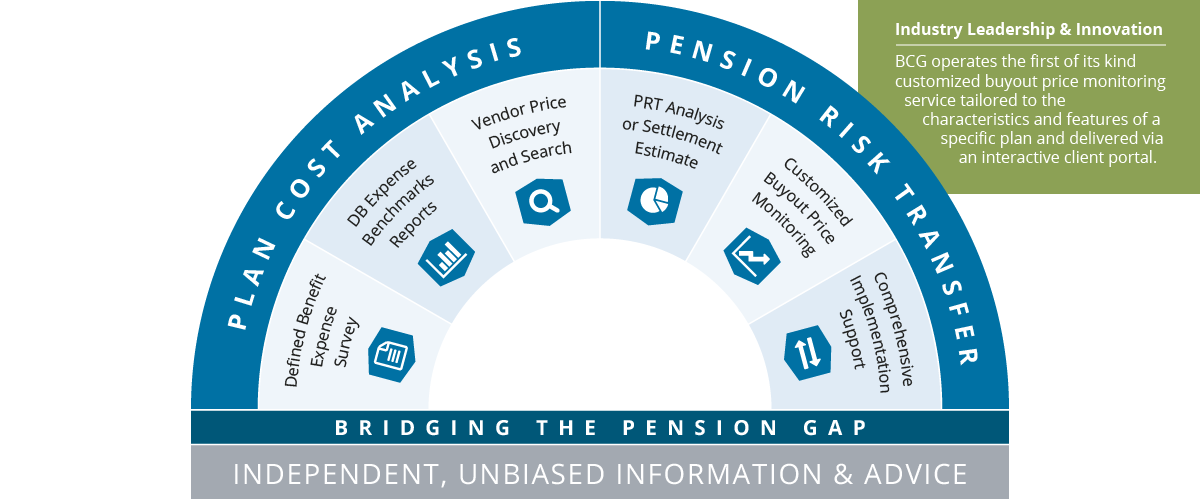

Industry Leadership & Innovation

BCG operates the first of its kind customized buyout price monitoring service tailored to the characteristics and features of a specific plan and delivered via an interactive client portal.

BCG operates the 1st and only one-of-its-kind Defined Benefit Expense Survey and DB Expense Benchmarks Reports.

To get a handle on your DB plan's expenses, click here:

Defined Benefit Plan Services

Defined Benefit Expense Survey

BCG conducts the only industrywide survey to capture all the costs associated with maintaining a U.S. corporate defined benefit pension plan. The survey process helps sponsors to identify the full range of plan expenses and to improve plan governance and efficiency.

DB Expense Benchmarks Reports

BCG DB Expense Benchmarks Reports allow plan sponsors to compare the expenses of their plans with those of other plans that participate in the BCG Defined Benefit Expense Survey. Benchmarks Reports can identify areas where plan sponsors may look for better cost efficiency in the operation of their plans.

Vendor Price Discovery and Search

For any category in a BCG DB Expense Benchmarks Report where plan expenses appear relatively high, BCG can provide an estimate of current market pricing for services in that category. BCG can also evaluate the cost savings and service enhancements that can be achieved through a bundled services arrangement and will assist with the search for qualified providers. To learn more, Contact Us.

PRT Analysis or Settlement Estimate

BCG’s PRT Analysis is ideal to help plan sponsors gain a better understanding of their DB plan’s liabilities, PRT options, expected costs, expense savings, implementation considerations, and next steps. A Settlement Estimate is an abridged version of the PRT Analysis providing a snapshot of a DB plan’s termination liability. To request a sample PRT Analysis or Settlement Estimate, Contact Us.

Customized Buyout Price Monitoring

BCG provides CBPM to plan fiduciaries who are pursuing an LDI strategy that takes into account the future liability obligations of a DB plan, which are reasonably anticipated to include annuity purchases and lump sum payment options. CBPM provides DB plans with up-to-date insight on expected liabilities, consults on the de-risking process and timing in support of investment strategy.

Comprehensive Implementation Support

BCG provides comprehensive implementation services for lump sum programs, annuity placements and full plan terminations. BCG also provides fulfillment services and acts as an Independent Expert in regards to DOL IB 95-1.

“Our plan specific CBPM service is an innovative solution that provides clients and their advisors the information and consulting necessary to optimize DB plan investment strategy throughout the de-risking journey.”

– Steve Keating, Managing Director, BCG Pension Risk Consultants | BCG Penbridge

Comprehensive Implementation Support

Team

Karen Ambrose

Senior Pension Consultant

Karen Ambrose

Senior Pension Consultant

kambrose@bcgpension.com

Karen is a Senior Pension Consultant at BCG Pension Risk Consultants | BCG Penbridge (BCG). She is responsible for facilitating the firm’s annuity search and placement process, serving as lead consultant on placement transactions. Karen works directly with the Operational team in Chicago and the firm's enrolled actuaries.

Karen is a Senior Pension Consultant at BCG Pension Risk Consultants | BCG Penbridge (BCG). She is responsible for facilitating the firm’s annuity search and placement process, serving as lead consultant on placement transactions. Karen works directly with the Operational team in Chicago and the firm's enrolled actuaries.

Experience

Karen has acquired extensive experience with more than 40 years in the insurance/pension industry, in the areas of ERISA compliance and defined benefit plan termination, with a focus on identifying and solving administrative issues relating to the settlement of liabilities in compliance with IRS, DOL and PBGC requirements. Prior to joining BCG Karen spent 23 years with Mercer Investment Consulting, the last ten years as business leader of Mercer’s annuity settlement/pension de-risking services. Karen has facilitated the wind-up of over 400 defined benefit retirement plans and PRT transactions. Prior to joining Mercer in 1991, Karen was both a regional manager and account executive in the group pension operations areas of both Equitable Life Assurance and CNA Insurance. Karen obtained her BA in Business and Economics from Benedictine University.

Dan Atkinson

Consulting Actuary

Dan Atkinson

Consulting Actuary

datkinson@bcgpension.com

Dan is a consulting actuary with BCG. In this role, Dan leads BCG’s Pension Risk Transfer analysis, where he is responsible for identifying and explaining cost and risk saving opportunities to plan sponsors, estimating current and future liabilities and costs for pension plans and serving as an ongoing resource for all pension-related questions that may arise. Dan also maintains BCG’s monthly “Customized Buyout Price Monitoring” analysis to improve plan and investment strategy; supports BCG’s annuity placement team, helping to drive the lowest possible annuity placement price and best plan sponsor experience during the process of placing annuities with insurers; and lends his expertise to BCG’s sales and marketing initiatives. With 20+ years of experience consulting with plan sponsors, Dan is uniquely positioned to help sponsors navigate their pension de-risking options, and make fully informed decisions regarding the future of their pension plan(s).

Dan is a consulting actuary with BCG. In this role, Dan leads BCG’s Pension Risk Transfer analysis, where he is responsible for identifying and explaining cost and risk saving opportunities to plan sponsors, estimating current and future liabilities and costs for pension plans and serving as an ongoing resource for all pension-related questions that may arise. Dan also maintains BCG’s monthly “Customized Buyout Price Monitoring” analysis to improve plan and investment strategy; supports BCG’s annuity placement team, helping to drive the lowest possible annuity placement price and best plan sponsor experience during the process of placing annuities with insurers; and lends his expertise to BCG’s sales and marketing initiatives. With 20+ years of experience consulting with plan sponsors, Dan is uniquely positioned to help sponsors navigate their pension de-risking options, and make fully informed decisions regarding the future of their pension plan(s).

Experience

Dan is a Fellow of the Society of Actuaries and an Enrolled Actuary under ERISA. He has over 20 years of pension plan experience, most recently serving as chief actuary at River and Mercantile Solutions, and previously consulting with plan sponsors as a pension actuary at Mercer and Fidelity Investments. Dan’s pension experience covers all aspects of single-employer corporate plans, from plan terminations and annuity placements to day-to day administration. He has served as the signing actuary for 5500 and PBGC purposes for dozens of plans. Dan’s experience includes consulting on all plan sizes, from small to jumbo, as well as corporate plans, church plans, single, multiple, and multi-employer pension plans. Dan graduated from Worcester Polytechnic Institute with a BS in Actuarial Mathematics.

Michael Devlin

Principal

Michael Devlin

Principal

mdevlin@bcgpension.com

Mike is a Principal at BCG. Mike oversees the firm's marketing and sales efforts as well oversees all operations of the firm. Mike's primary focus is helping clients develop a clear path to termination that includes modeling, analyzing and implementing solutions across the de-risking spectrum. Strategies include liability driven investment strategies, purchasing annuities for retirees, pursuing full risk transfer through plan termination, as well as the strategic positioning of plan design & structure for optimal attractiveness to eventual annuity providers.

Mike is a Principal at BCG. Mike oversees the firm's marketing and sales efforts as well oversees all operations of the firm. Mike's primary focus is helping clients develop a clear path to termination that includes modeling, analyzing and implementing solutions across the de-risking spectrum. Strategies include liability driven investment strategies, purchasing annuities for retirees, pursuing full risk transfer through plan termination, as well as the strategic positioning of plan design & structure for optimal attractiveness to eventual annuity providers.

Experience

Mike has more than 20 years’ experience helping companies and organizations across a variety of industries achieve their defined benefit pension de-risking goals. He has helped over 500 plan sponsors achieve their goals in regards to their pension plan.

Mike started his career with BTR based in London, England before moving on to KPMG and their retirement plan business. While at KPMG he consulted on the KPMG Pension Plan as well as other key clients who were looking for alternatives to managing their pension risk. He eventually moved on to The Hartford where he worked with plan sponsors, advisors and consultants in the DB market.

Mike is a regular speaker at various national conferences on pension de-risking strategies. Mike holds his FINRA Series 6, 63 and 65 security licenses and his life and health insurance licenses. Mike graduated from The Pennsylvania State University with a degree in Business.

George Eknaian

Consultant

George Eknaian

George consults with BCG and is the owner of AVM Actuarial and Pension Risk Consulting. At BCG, George is involved in special projects designed to enhance BCG’s client deliverables, and provides his expertise in support of strategic initiatives.

George consults with BCG and is the owner of AVM Actuarial and Pension Risk Consulting. At BCG, George is involved in special projects designed to enhance BCG’s client deliverables, and provides his expertise in support of strategic initiatives.

Experience

George is a Fellow of the Society of Actuaries, a Chartered Financial Analyst and a Chartered Enterprise Risk Analyst. George’s strength is in the pricing and asset-liability management of annuities and defined benefit pension risk transfers, due diligence review of insurance companies, the appraisal of potential insurance company acquisitions and party-appointed arbitration requiring actuarial expertise.

George has held a number of positions in the insurance industry, most recently serving as Head of Pricing for Talcott Resolution, responsible for pricing of all business development opportunities. Prior to founding his own business, George served as Senior Vice President and Chief Actuary of The Hartford’s Wealth Management and Global Annuities business. In his tenure, he was responsible for product review, reinsurance placement, oversight of statutory and GAAP valuation, pricing, asset-liability management, and the co-development of investment and hedging strategies relating to the Wealth Management and Global Annuities business.

George also served as Chief Actuary of the Institutional Annuity business and Corporate Actuarial functions for Travelers Life and Annuity prior to his employment at The Hartford. Currently, George is a member of the SOA, the American Academy of Actuaries, and the CFA Institute and is involved in several volunteer roles in non-profit organizations.

In 2019, George was a key member of BCG’s team that advised a PRT insurer in the execution of the first-ever PRT longevity reinsurance transaction in the US.

David Geloran

Senior Pension Consultant

David Geloran

Senior Pension Consultant

dgeloran@bcgpension.com

David Geloran, Senior Pension Consultant, is responsible for marketing, new business development, and client relationship management at BCG Pension Risk Consultants | BCG Penbridge (BCG).

David Geloran, Senior Pension Consultant, is responsible for marketing, new business development, and client relationship management at BCG Pension Risk Consultants | BCG Penbridge (BCG).

Experience

David has over 28 years’ experience in the retirement plan industry, and works with advisors, plan sponsors, actuaries, administrators, and ERISA counsel, with respect to all aspects of BCG service delivery. He manages plan termination notice and election fulfillment services, which provide plan sponsors an alternative to the high price many actuarial firms require to prepare required notices and election packages for plan terminations.

Prior to joining BCG, David was the product owner for the defined benefit product at Empower Retirement, and was responsible for all aspects of defined benefit plan services, sales and operations. David’s experience in the retirement industry encompasses actuarial, plan consulting, compliance and administration for many types of defined benefit and defined contribution plans, as well as software engineering and management.

David currently maintains his CEBS designation with the International Foundation of Employee Benefit Plans. He received his Bachelor of Science in Mathematics from the University of Louisville and a Master of Business Administration from Clark University Graduate School of Management.

Rosaria Haley

Operations Coordinator

Rosaria Haley

Operations Coordinator

rhaley@bcgpension.com

JRosaria is an Operations Coordinator with BCG. She assists clients and the operations team by providing administrative and organizational support to ensure smooth and efficient daily operations of the office.

JRosaria is an Operations Coordinator with BCG. She assists clients and the operations team by providing administrative and organizational support to ensure smooth and efficient daily operations of the office.

Experience

Rosaria is a highly organized and detail-oriented individual with 10+ years’ experience providing administrative support.

Jack Hayes

Actuarial Analyst

Jack Hayes

Actuarial Analyst

jhayes@bcgpension.com

Jack is an actuarial analyst with BCG. He is responsible for analyzing client data to identify cost and risk reduction opportunities and estimating current and future liabilities and costs for pension plans as part of pension de-risking consulting projects. Jack provides support to BCG’s client deliverables covering pension risk transfer analysis, customized buyout price monitoring, fulfillment services as well as annuity placements. Jack is based in Braintree, MA.

Jack is an actuarial analyst with BCG. He is responsible for analyzing client data to identify cost and risk reduction opportunities and estimating current and future liabilities and costs for pension plans as part of pension de-risking consulting projects. Jack provides support to BCG’s client deliverables covering pension risk transfer analysis, customized buyout price monitoring, fulfillment services as well as annuity placements. Jack is based in Braintree, MA.

Experience

Jack started his professional career at BCG with a BS in Actuarial Science and a minor in Data Science, graduating in 2022 from Loyola University Maryland.

Stephen Keating

Managing Director

Stephen Keating

Managing Director

skeating@bcgpension.com

LinkedIn

Steve is Managing Director at BCG Pension Risk Consultants | BCG Penbridge (BCG). He has over 20 years of experience in defined benefit (DB) pension consulting. Steve focuses on helping DB plan sponsors evaluate plan cost, consider pension de-risking alternatives, and choose annuity products and insurance companies. Steve also advises insurers on pension risk transfer (PRT) market entry preparedness and reinsurance placements.

Steve is Managing Director at BCG Pension Risk Consultants | BCG Penbridge (BCG). He has over 20 years of experience in defined benefit (DB) pension consulting. Steve focuses on helping DB plan sponsors evaluate plan cost, consider pension de-risking alternatives, and choose annuity products and insurance companies. Steve also advises insurers on pension risk transfer (PRT) market entry preparedness and reinsurance placements.

At BCG, Steve is a lead consultant for PRT analysis and annuity placement transactions, supporting plan sponsors in both their settlor and fiduciary capacities. Additionally, Steve is responsible for creating new channels for BCG’s services and developing new solutions and services that drive BCG’s growth.

Experience

Steve has broad institutional retirement and investment experience and a demonstrated record of strategic business development and thought leadership achievement. While Steve’s work has covered all aspects of DB plan management, he has particularly focused on the development of the PRT market in the US over the past 15+ years. Prior to joining BCG, Steve was Founder of Penbridge Advisors, a specialist PRT advisory and information services firm, which was acquired by BCG Pension Risk Consultants in February 2018.

Steve has led the design, creation and delivery of key client engagements as well as internal business development initiatives. Recent highlights include: (1) establishing a relationship with an independent secondary market advisory firm to help BCG clients liquidate their alternative asset (illiquid) investments at the best possible price as part of the plan termination process (2) creating a new Customized Buyout Price Monitoring (CBPM) service for plan fiduciaries and advisors. CBPM provides DB plans with up-to-date insight on expected liabilities and ongoing consulting on the de-risking process and timing in support of investment strategy; (3) establishing a collaborative advisor offering with a leading global asset manager to jointly deliver LDI and CBPM services; and (4) establishing BCG’s PRT reinsurance services which included advising on the first-ever longevity reinsurance transaction in the US which was completed in 2019.

Steve is a regular speaker at industry events on pension cost and risk issues, has provided written testimony and testified before the Department of Labor’s ERISA Advisory Council and authors or co-authors numerous articles, spotlight Q&A interviews and surveys on these topics, including the featured article each month in BCG's highly followed industry newsletter, The BCG Pension Insider.

Prior to BCG and Penbridge, Steve was a Managing Director at River and Mercantile Group PLC, Head of the Pension Solutions Group at Lazard and served as a Senior Consultant at Hewitt Associates where he helped build Hewitt’s multinational pension risk management practice. Steve obtained his BS in Engineering from Syracuse University and in Summer 2022 completed the Executive Program for Growing Companies at Stanford Graduate School of Business.

News

- The BCG Pension Insider Featured Articles Fuel Audience Growth as a Leading US Pension De-Risking Industry Resource | 07.2024

- Stanford’s EPGC - A Transformational Experience for BCG’s Steve Keating | 08.2022

- BCG’s Steve Keating to attend Stanford Graduate School of Business Executive Education Program | 07.2022

- PBGC Licenses Annuity Buyout Pricing Data from BCG to Support Monitoring of Group Annuity Pricing for US Defined Benefit Pension Plans | 03.2022

- Bloomberg Businessweek - Companies Decide the Time Is Right to Offload Pensions to Insurers | 10.2021

- BCG Launches Spotlight Series to Cover Topics of Interest in the Pension De-Risking Industry | 07.2021

- BCG Pension Risk Consultants Announces First of Its Kind End-to-End Solution for Defined Benefit Pension Plans | 01.2021

- BCG Pension Risk Consultants Unveils New Corporate Brand and Website and Launches Customized Buyout Price Monitoring “CBPM” Service | 06.2020

- BCG Pension Risk Consultants Acquires Penbridge Advisors | 03.2018

Publications

- Spotlight Series Q&A with Clifford Chance: Entering the Pension Risk Transfer Market as a New Insurer – The Legal Perspective | 06.2024

- Pension Risk Transfer Market Entry – Considerations for Insurers | 05.2024

- Spotlight Series Q&A with Legal & General: Delivering Pension Plan Outcomes on Both Sides of the Atlantic | 04.2024

- Pension Risk Transfer Annuity Placement Pricing Remains Historically Attractive | 03.2024

- Spotlight Series Q&A with Nationwide: Building a PRT Insurance Business Centered on Operational Excellence | 02.2024

- BCG Thought Leadership 2023 Roundup, Three Pension De-Risking Market Predictions for 2024 and A Tip of the Hat | 01.2024

- The Critical Role LDI Plays to Lock In DB Plan Funded Status Inflection Points | 12.2023

- Spotlight Series Q&A with MetLife: Top Trends in Today’s Rapidly Growing US Pension Risk Transfer Market | 11.2023

- Two Foundational Questions that Demand C-Suite/Board Attention | 10.2023

- My Defined Benefit Plan is Overfunded on a Plan Termination Basis – Now What? | 09.2023

- Spotlight Series Q&A with F&G: Navigating Mortality Risk: The 9-Digit Zip Code Advantage in Pension Risk Transfer Annuities | 08.2023

- Spotlight Series Q&A with Ortec Finance: The Importance of Looking Ahead for Defined Benefit Plan Sponsors | 07.2023

- Plan Sponsors Beware – Participating Group Annuity Contracts in DB Plans | 06.2023

- Fiduciary Considerations in the Context of IB 95-1 | 05.2023

- Spotlight Series Q&A with Goldman Sachs Asset Management: Why Conditions Remain Ripe for Pension De-Risking | 04.2023

- Spotlight Series Q&A with NISA Investment Advisors: Breaking Down the Hibernation vs. Termination Decision | 03.2023

- Pension Risk Transfer Market Observations in Five Charts | 02.2023

- Spotlight Series Q&A with Ivins, Phillips & Barker: Fiduciary Considerations for an Expanding U.S. Pension Risk Transfer Market | 01.2023

- BCG Thought Leadership 2022 Roundup, A Look Ahead to How the Pension De-Risking Market is Evolving in 2023 and Beyond and A Big Thank You | 01.2023

- COVID-19 Pandemic and Future Pension Risk Transfer Mortality – What’s Next? | 12.2022

- Spotlight Series Q&A with Corebridge Financial: The Growing Use of Buy-ins to Secure the Path Toward Eventual Plan Termination | 11.2022

- The UK Pension Market Crisis and Why the US Pension Market Is Different | 10.2022

- Spotlight Series Q&A with Prudential: A Pension Risk Transfer Market Update with an Industry Pioneer | 09.2022

- Technical Impediments to Pension De-Risking | 08.2022

- Pension De-Risking – The Time for Plan Sponsor Action Is Now | A BCG Special Feature in Collaboration with BofA Global Research | 07.2022

- Tips for a CFO’s Better Night’s Sleep | 06.2022

- Factors Determining Whether an Insurer Will Decide to Bid on a PRT Annuity Placement | 05.2022

- Spotlight Series Q&A with Groom Law Group: Addressing Alternative Assets in Defined Benefit Plan Terminations – The Legal Perspective | 04.2022

- Rising Interest Rates | 04.2022

- Spotlight Series Q&A with Athene: Pension Plan Funding Has Reached an Inflection Point – Considerations for Larger Plan Sponsors | 02.2022

- BCG Thought Leadership 2021 Roundup and A Look Ahead to How the Pension De-Risking Market is Evolving in 2022 and Beyond | 01.2022

- Expanding the Pension De-Risking Toolkit – Longevity Risk Transfer | 12.2021

- Addressing Alternative Assets in Defined Benefit Plan Terminations – Considerations for Plan Sponsors | 11.2021

- Spotlight Series Q&A with Canada Life Re: COVID-19 Insights and Considerations for Pension De-risking | 10.2021

- Is your Defined Benefit plan hard frozen? | 08.2021

- Spotlight Series Q&A with RGA: Developments in Longevity Risk Management for PRT Transactions | 07.2021

- Highlights from BCG’s 2021 Survey of Asset-In-Kind Practices of Annuity Providers | 06.2021

- Pension Risk Transfer Annuity Placement Pricing is Better Than Ever – Will it Last? | 05.2021

- Liability Driven Investing When Plan Termination is the “Endgame” Objective | 04.2021

- Pension De-Risking – A Recommended First Step | 03.2021

- Major Insurers Flock to U.S. Pension Risk Transfer Market | 02.2021

Speeches & Presentations

- APIC Wealth Management 3.0 - The $3 Trillion Opportunity – How to Engage with Your Clients’ CFOs on Pension De-Risking | 06.2023

- Teach-In + Pension Risk Transfer Overview with BofA Securities, Inc. | 01.2023

- LOMA GRIPC Spring 2002 Meeting on the Current State of the U.S. Pension Risk Transfer Market PRT Market from the Consultant Perspective | 04.2022

- Citi European Life Insurance Research Webinar on the Current State of the U.S. Pension Risk Transfer Market | 11.2021

- Columbia Threadneedle Workshop Series for Retirement-Focused Advisors: Defined Benefit Opportunities for DC Focused Advisors | 09.2021

- BCG Defined Benefit Webinar – Taking Control of Your Credit Union Pension Plan | 07.2021

- Pension Group East Webinar on the Current State of the U.S. Pension Risk Transfer Market | 06.2021

- Citi European Life Insurance Research Webinar on the Current State of the U.S. Pension Risk Transfer Market | 12.2020

- SOA Annual Meeting – PRT Reinsurance in the US: A Market in the Making | 10.2019

- SOA Reinsurance Seminar – The Pension Risk Transfer-mation: Market Overview and Intro to Reinsurance | 09.2019

- AICPA Employee Benefit Plans Conference – Both Direct and Indirect DB Pension Costs Need Audit Attention | 05.2019

Anna Lesak

Operations Coordinator

Anna Lesak

Operations Coordinator

alesak@bcgpension.com

Anna has served as the Operations Coordinator at BCG for over 5 years. She assists clients and the operations team by providing complex project management of the activities associated with annuity placements and pension risk transfer strategies. Acting as the liaison between BCG, the plan sponsor, and other providers, Anna provides detailed oversight throughout the annity placement process to ensure optimal service and result.

Anna has served as the Operations Coordinator at BCG for over 5 years. She assists clients and the operations team by providing complex project management of the activities associated with annuity placements and pension risk transfer strategies. Acting as the liaison between BCG, the plan sponsor, and other providers, Anna provides detailed oversight throughout the annity placement process to ensure optimal service and result.

Experience

Anna has over 30 years of corporate business experience, including detailed project management in finance, sales and marketing, information systems, accounting and human resources. Anna attended south Suburban College in Illinois with an emphasis in Business Communication.

David McCain

Actuarial Analyst

David McCain

Actuarial Analyst

dmccain@bcgpension.com

David is an actuarial analyst with BCG. He is responsible for identifying both cost and risk reduction opportunities along with providing estimates of current and future liabilities as a part of pension de-risking consulting projects with BCG. David provides contributions towards the development of actuarial models for risk analysis of pension plans. Additionally, David aids BCG's client deliverables focusing on pension risk transfer analysis and annuity placements. David is based in Braintree, MA.

David is an actuarial analyst with BCG. He is responsible for identifying both cost and risk reduction opportunities along with providing estimates of current and future liabilities as a part of pension de-risking consulting projects with BCG. David provides contributions towards the development of actuarial models for risk analysis of pension plans. Additionally, David aids BCG's client deliverables focusing on pension risk transfer analysis and annuity placements. David is based in Braintree, MA.

Experience

David began his professional career at BCG as an intern in 2022, returning fulltime after graduating in 2023 from Bryant University with a BS in Actuarial Mathematics and a double minor in Finance and Business Administration.

Patrick McLean

Principal Emeritus

Patrick McLean

Principal Emeritus

pmclean@bcgpension.com

Pat is currently responsible for overseeing BCG's carrier due diligence activities. Prior to becoming Principal Emeritus, he was a Principal responsible for overseeing BCG's activities pertaining to negotiating, implementing and finalizing pension risk transfer transactions on behalf of the firm's clients.

Pat is currently responsible for overseeing BCG's carrier due diligence activities. Prior to becoming Principal Emeritus, he was a Principal responsible for overseeing BCG's activities pertaining to negotiating, implementing and finalizing pension risk transfer transactions on behalf of the firm's clients.

Experience

Pat started his career as a CPA with Peat, Marwick, Mitchell & Co., CPAs in their Houston office in 1966, then joined the Austin office of KMG Main Hurdman (now KPMG) as Senior Partner overseeing the office's Tax and Financial Services groups. In July 1990, Pat acquired Terminal Funding Co., one of the original US pension risk transfer companies, which merged with BCG in 2003 to form BCG Terminal Funding Co. which was renamed BCG Pension Risk Consultants in 2014 and BCG Pension Risk Consultants | BCG Penbridge in 2020.

Pat's over 50 years of experience in retirement benefits, taxation and financial management services affords him the ability to provide a wide variety of assistance to BCG's pension risk transfer clients.

Pat graduated from the University of Texas at Austin with undergraduate and graduate degrees in accounting.

Sean O'Flaherty

Managing Sales Director

Sean O'Flaherty

Managing Sales Director

sean@bcgpension.com

Sean is Managing Sales Director of the Western Region. In this role, Sean is responsible for creating new business opportunities for the firm's services. This includes creating new distribution channels through Plan Sponsors, Actuarial Firms, ERISA Law Firms, Advisory Firms and Insurance Firms. Sean will also serve as lead consultant for PRT analysis engagements and annuity placement transactions.

Sean is Managing Sales Director of the Western Region. In this role, Sean is responsible for creating new business opportunities for the firm's services. This includes creating new distribution channels through Plan Sponsors, Actuarial Firms, ERISA Law Firms, Advisory Firms and Insurance Firms. Sean will also serve as lead consultant for PRT analysis engagements and annuity placement transactions.

Experience

Sean has broad institutional retirement and investment experience with a demonstrated record of strategic business development. Sean has been in the financial services industry since 1991 and has been a speaker at industry events, including the national convention of ASPPA (American Society of Pension Professionals & Actuaries) regarding the topic of Pension Risk Transfer. Sean is married with three children and resides in Eagle, Idaho.

Samantha Okamoto

Actuarial Assistant

Samantha Okamoto

Actuarial Assistant

saokamoto@bcgpension.com

Samantha is an Actuarial Assistant with BCG. She assists with PRT analyses, annuity estimates, preparing bid specifications, and reviewing proposals for annuity purchases.

Samantha is an Actuarial Assistant with BCG. She assists with PRT analyses, annuity estimates, preparing bid specifications, and reviewing proposals for annuity purchases.

Experience

Samantha started her career with Midwest Consulting Actuaries before joining BCG in 2015. She received a BS in Actuarial Science from Indiana University Northwest.

David Rumas

Consulting Actuary

David Rumas

Consulting Actuary

drumas@bcgpension.com

Primary role is to lead successful annuity placement services; including but not limited to ensuring client deliverables/communications are timely and accurately completed, monitoring annuity purchase marketplace, performing actuarial valuations/expense analysis of pension plans, preparation, review and presentation of key findings, assist in marketing efforts and initiatives, daily consultations with advisors, actuaries, and other interested parties. Manage and ensure completion of post-placement activities. Serve as an internal and external resource.

Primary role is to lead successful annuity placement services; including but not limited to ensuring client deliverables/communications are timely and accurately completed, monitoring annuity purchase marketplace, performing actuarial valuations/expense analysis of pension plans, preparation, review and presentation of key findings, assist in marketing efforts and initiatives, daily consultations with advisors, actuaries, and other interested parties. Manage and ensure completion of post-placement activities. Serve as an internal and external resource.

Experience

Dave has worked with all types of defined benefit plans (traditional, cash balance, pension equity, etc.), defined contribution and retiree medical plans’ consulting with clients ranging in size from Fortune 100 corporations to a single participant plans with varying degrees of complexity.

He has over 35 years of comprehensive pension plan experience serving as a Director at both Deloitte and RSM McGladrey, and as a Senior Manager at both Mesirow Financial and Price Waterhouse. Over the past fifteen years, Dave has focused primarily in the plan termination arena, assisting clients effectively and expediently toward settlement of their pension benefit obligations. He has successfully completed/managed over 200 annuity placements.

Additionally, he assisted plan sponsors in identifying and reducing costs/risks inherent in the ongoing operation of their plan; including assessing viability of partial settlement actions (e.g., annuity purchases and lump sum windows), evaluating economic costs inherent in maintaining the plan, consulting on plan termination implementation and readiness challenges/constraints. Experience working directly in-depth with insurers, actuaries, financial advisors, accountants, and legal counsel have provided Dave well-rounded knowledge to recommend, implement and successfully achieve pension risk transfer initiatives.

Will Sandifer

Pension Consultant

Will Sandifer

Pension Consultant

wsandifer@bcgpension.com

Will is a Pension Consultant at BCG Pension Risk Consultants | BCG Penbridge (BCG). He is responsible for facilitating the firm’s annuity search and placement process, serving as lead consultant on placement transactions.

Will is a Pension Consultant at BCG Pension Risk Consultants | BCG Penbridge (BCG). He is responsible for facilitating the firm’s annuity search and placement process, serving as lead consultant on placement transactions.

Experience

Will has over 10 years’ experience in the defined benefit retirement plan consulting field, with a particular focus on plan terminations and other pension risk transfer initiatives. He has managed multiple plan terminations, lump sum windows, and annuity placements throughout his career. Prior to joining BCG, Will worked as a plan termination manager at both Mercer and Willis Towers Watson as well as a Senior Associate Actuarial Analyst at River and Mercantile and Aon Hewitt. Will received his Bachelor of Science in Mathematics from Louisiana State University in Shreveport and his Master of Science in Mathematics from The University of Denver.

Debbie Sharp

Managing Sales Director

Debbie Sharp

Managing Sales Director

dsharp@bcgpension.com

Debbie is Managing Sales Director at BCG. Her primary role is marketing the firms services through the acutarial and ERISA attorney avenues. In addition, she also manages the call center in the Kentucky office.

Debbie is Managing Sales Director at BCG. Her primary role is marketing the firms services through the acutarial and ERISA attorney avenues. In addition, she also manages the call center in the Kentucky office.

Experience

Debbie has a broad range of experience in group and individual annuity placement. She started her career dealing primarily with individual qualified and non-qualifed annuities. This lead into working directly with actuaries and plan sponsors dealing with defined benefit plan terminations and carve outs.

Debbie started Sharp Benefits, Inc, which primarily dealt with group annuity placements for small to medium size qualified defined benefit plans through the actuarial community.

Later Debbie joined with BCG Terminal Funding Company and began to move into the mid to large size annuity placements, as well as development of relationship with various financial firms.

Debbie has obtained the certification of CEBS as well as holding a life license.

Crystal Simpson

Client Services Associate

Crystal Simpson

Client Services Associate

csimpson@bcgpension.com

Crystal is a Client Service Associate at BCG. In this role, Crystal is responsible for supporting the firm's communications with actuaries, consultants, brokers and attorneys regarding qualified and non qualified pension plans with the objective of educating the marketplace on BCG's services and capabilities covering pension risk consulting and PRT Placement and Administrative Support Services.

Crystal is a Client Service Associate at BCG. In this role, Crystal is responsible for supporting the firm's communications with actuaries, consultants, brokers and attorneys regarding qualified and non qualified pension plans with the objective of educating the marketplace on BCG's services and capabilities covering pension risk consulting and PRT Placement and Administrative Support Services.

Experience

She have been with BCG since May 2010 and has worked in the customer service arena for 20 years.

Rose Thomas

Client Services Director

Rose Thomas

Client Services Director

roset@bcgpension.com

Rose is responsible for client services coordination, maturity funding placements for the Firm (employer purchased qualifed individual annuities), internal IT coordination and implementation, special projects development and management, and back-up the Group Annuity Operations Division.

Rose is responsible for client services coordination, maturity funding placements for the Firm (employer purchased qualifed individual annuities), internal IT coordination and implementation, special projects development and management, and back-up the Group Annuity Operations Division.

Experience

Rose has over 30 years experience in the group and individual pension risk transfer/liability settlement space, working on both qualified and non-qualified annuity placements.

Rose also has extensive experience working for national and large local accounting firms, and with commercial property development/management entities.