The BCG Pension Insider

October 2022 – Volume 132, Edition 1

The UK Pension Market Crisis and Why the US Pension Market Is Different

When the tide goes out it becomes more dangerous to navigate a harbor as rocks and shoals are nearer a ship’s hull and threaten destruction. The financial market corollary is central banks draining liquidity and exposing financial institutions to potential demise. Monetary authorities are now in a tightening mode across the world. Institutions that do not have well designed asset-liability hedging strategies are in peril. Historic examples of flawed strategies include: the 2008 financial crisis, the 1998 Long Term Capital Management crisis, and the banking and savings and loan crises of the 1980s and 1990s.

The U.K. pension market crisis is the first casualty in this tightening cycle. This chart shows the unprecedented contraction of central bank balance sheets; the U.K. had been scheduled to begin reduction of their bond holdings October 15, however this was delayed due to the U.K. pension market dislocation. Short term rates were increased in this time period.

Source: BofA Global Investment Strategy, Bloomberg, Haver

The U.K. Pension Market Crisis

The upheaval in U.K. pensions occurred as monetary conditions were being tightened and the new Prime Minister introduced expansive and inflationary tax cuts. This started to push yields higher on long U.K. government bonds known as gilts and the rise accelerated as U.K. pension plans were forced sellers of long bonds to meet margin calls. The rapidity of the rate rise caused an immediate need for cash from plans that were using long swaps as a liability hedge. To raise the required cash, gilts and other assets were sold pushing yields higher and requiring still more gilts to be sold.

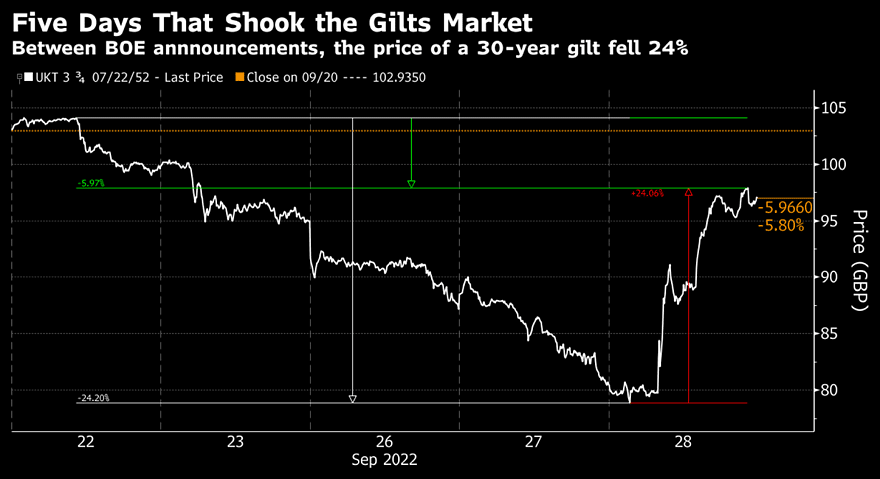

This vicious “doom loop” was halted only when the Bank of England (BoE) stepped in and announced they stood “ready to buy as many gilts as necessary…at an urgent pace” to stabilize markets. The chart below shows the price of 30-year bonds in the days leading up to and after the BoE’s action; bonds dropped 24% in price, and after the BoE’s action recovered for a net decline of 6%. During this period, pension plan managers were forced sellers to meet margin calls in a market that had ceased to trade. Without BoE intervention U.K. pension plans faced imminent widespread insolvency and the country’s economic prospects would have been set back. As it stands today some plans will no doubt have suffered losses that will not be recouped.

Source: Bloomberg Finance L.P.

The design of the U.K. pension strategy did not anticipate an almost instantaneous multi-standard deviation drop in bond prices in a market where it was no longer possible to transact. The use of swaps, leveraged by nature, allowed plans to hedge interest rate risk with about one third of plan assets while the remaining assets were invested in additional return seeking assets, including more long gilts. The added assets together with the “Black Swan” nature of rocketing interest rates with no ability to trade laid bare the risk in the U.K.’s liability driven investment “LDI” approach to pension management.

Why the U.S. Pension Market Is Different

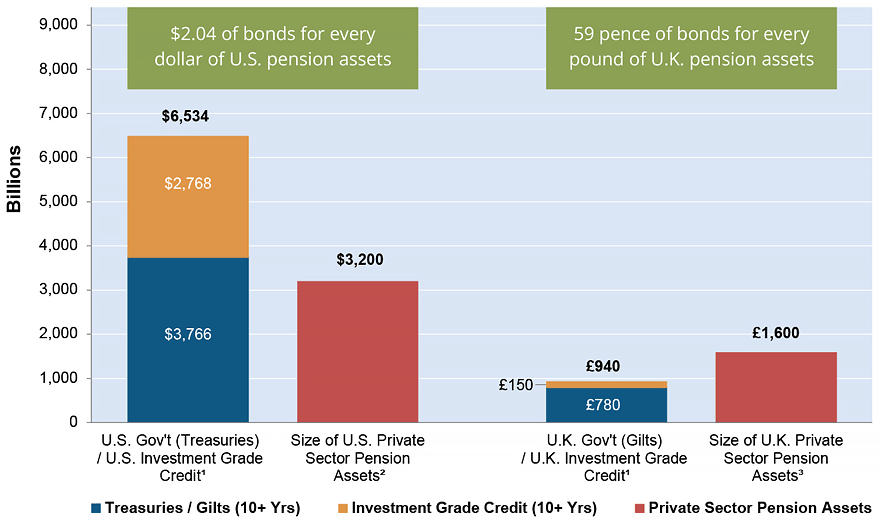

U.S. pension plans are structured differently than U.K. plans in many respects. Leverage is not common in U.S. plans, nor is it looked upon favorably by regulators. The long end of the U.S. Treasury and corporate bond market is large relative to corporate pension liabilities and provides a viable cash-based liability hedge. The U.K. does not have as large and diverse a long-term bond market and the need for swaps opened pensions to overuse of leverage.

U.S. and U.K. Long Term Bond Markets (10+ Yrs) Relative to Size of Private Sector Pension Assets as at June 30, 2022

1 Source: ICE Data Indices, LLC; BofA Global Research

2 Source: Investment Company Instititute; bit.ly/3VhJmN4

3 Source: PwC; pwc.to/3CswP0C

Corporate governance in the U.S. is more streamlined with plan sponsors bearing responsibility for meeting payments to plan participants. Corporations make pension funding, investment and liability management decisions within corporate financial capabilities. U.K. plans often have pension trustee boards composed of labor and management with decision making subject to conflicting (stability vs. growth) goals often resulting in less-than-optimal decisions.

U.S. plans are making significant headway in reducing pension liabilities, effectively managing risk and achieving plan goals. The Federal Reserve normally tightens financial conditions until there are financial dislocations, and these can be severe. Periods of market volatility can present attractive pricing opportunities for pension de-risking that might otherwise not develop or take years to unfold.

Having a team on board that can identify and seize such opportunities with an eye to achieve long term de-risking goals is critical. Being prepared can make all the difference. Let BCG help.

In preparing this article, BCG worked in collaboration with Frank Salem, an experienced fixed income and liability driven investment portfolio manager.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 4.89%

Term Vesteds (duration of 10) – 4.85%

Actives (duration of 15) – 4.76%

Annuity Purchase Rates as of October 1, 2022