The BCG Pension Insider

April 2022 – Volume 126, Edition 1

Spotlight Series – Q&A with Groom Law Group

Addressing Alternative Assets in Defined Benefit Plan Terminations – The Legal Perspective

Groom Law Group, Chartered

| Headquarters | Washington, DC |

| Year Founded | 1975 |

| Area of Focus | ERISA, Employee Benefits |

| Website | www.groom.com |

David N. Levine, J.D.

Co-Chair, Plan Sponsor Group

Co-Chair, Plan Sponsor Group

David co-chairs Groom Law Group, Chartered’s Plan Sponsor Group. Groom is the largest employee benefits law firm in the United States with nearly ninety lawyers focusing on all aspects of benefits – from health and retirement plans, to IRAs, to litigation and policy involving these plans. David regularly focuses on fiduciary and practical compliance issues involving pension plans, including their wind-down and de-risking.

David Levine can be contacted at 202-861-5436, or dlevine@groom.com

BCG: Can you tell us a bit about Groom’s work in terminating defined benefit plans and how it has evolved in recent years?

Levine: Since its founding in 1975, Groom has long been a thought leader in guiding the creation, administration and maintenance, and preparation for and termination of defined benefit plans. In recent years, with a significant number of large corporate defined benefit plans being “frozen” to future benefit accruals, a significant focus of our defined benefit pension plan practice has shifted to de-risking, compliance (including significant Department of Labor investigations involving missing participants and cybersecurity), and implementing terminations (whether of fully funded or underfunded plans) of our clients’ defined benefit plans through their post-termination PBGC audit phase.

BCG: In November 2021, we published an article about Addressing Alternative Assets in Defined Benefit Plan Terminations – Considerations for Plan Sponsors. As counsel to pension plans of all sizes – from smaller professional services companies to the largest of the Fortune 500 – do you see considerations relating to alternative assets in pension plans being a significant focus at this point?

Levine: Absolutely. With the ever-increasing focus on defined benefit plan investigations and scrutiny of pension terminations, a lot of our focus is working collaboratively with advisors, consultants like BCG, actuaries, recordkeepers and internal benefits staff on preparing for termination. As plan fiduciaries prepare their pension plans for their final phases, a key discussion we regularly have is ensuring that plan assets are in a form that allows the implementation of the plans for their wind-down in a manner consistent with plan fiduciaries’ duties under ERISA, the key law governing the operation and termination of pension plans. While the liquidity of pension plan assets to facilitate monthly and annual pension plan payments is a key concern for operational compliance under ERISA, this focus on alternative asset classes, if any, and their liquidity often increases as a plan approaches termination.

BCG: Why is it that alternative assets are a particular focus for you as you advise clients with pension plans approaching the termination process?

Levine: Put simply, under ERISA, plan fiduciaries have a duty to invest pension plan assets in a prudent manner that diversifies risk and ensures that a pension plan has assets sufficient to fund the benefits payable to participants and beneficiaries. Defined benefit pension plans of all sizes have long looked to alternative assets as a portfolio diversifying alternative to address their fiduciary duties under ERISA and many pension plans have benefited from investing in alternative assets. However, some alternative asset classes have liquidity “gates” or other restrictions that limit the ability to immediately liquidate these investments.

In an ongoing pension plan, the unique liquidity attributes of some alternative asset classes, such as the length of the “J curve” for private equity, is regularly managed as part of an ongoing fiduciary process that may be reflected in a pension plan’s investment policy statement. However, when a pension plan is terminated, all plan assets have to be distributed or annuitized and a pension plan alternative investment may not have time to complete its regular investment cycle.

BCG: When do you encourage a client to focus on alternative assets in their pension portfolio and are there any general rules of thumb you can recommend for our readers?

Levine: In most cases, the process of getting to the final termination of a pension plan, unless it is a distress termination in bankruptcy, follows a pretty consistent series of steps. Although not always the case, it is common that a plan is “frozen” to future accruals at some point which means that no further benefits under the plan are earned, or, in lawyer-speak, “accrued”. After that point, it is common that the plan fiduciaries will, as a plan becomes better funded over time, attempt to “de-risk” investments so that there is less risk of a downside investment event dramatically increasing a pension plan’s underfunding. Eventually this de-risking reaches a point where plan termination becomes feasible.

When a plan freezes or begins to de-risk, it can be a good time to flag any alternative investments to ensure that these investments have an investment horizon that will not exceed the expected life of the pension plan. In addition, we may at this point, working with other advisors as appropriate, begin discussions of paths to address potential liquidity issues to ensure alternative investments do not delay the future termination process.

BCG: When a client is about to enter the formal pension termination process, are there additional items that become important to focus on?

Levine: Yes. As the BCG team knows well, the pension termination process involves a significant number of steps and once the formal plan termination process is implemented, many deadlines are triggered. For example, while a cash balance pension plan may have always allowed for lump sum distributions for terminated employees, it is common practice for a plan that is terminated to allow for a one-time window during which all participants – even those who are still active employees of an employer – may elect to receive a lump sum. Depending on the demographics of a pension plan, this lump sum can cause a need to liquidate alternative assets earlier.

Further, there is always the basic question of “what can I do” with my alternative assets when a plan is in its final payout stage. Some alternative assets may have buyers on the secondary market, but not all do. At that point, we often have to explore more creative options involving in-kind transfers to insurance carriers or other parties. Layered into this discussion are ERISA’s prohibited transactions rules that can limit some of the methods that can be utilized to make alternative assets liquid. As a result, depending on the structure of a pension plan’s investments, early identification and proactive attention to this issue can help minimize the risk of a potential bad outcome – such as a need to “un-terminate” a pension plan.

BCG: In closing, what do you see as distinguishing Groom from other law firms that advise on pension plan terminations?

Levine: What distinguishes Groom is our level of expertise in this area. From our inception right after the enactment of ERISA in 1974, we have been involved in every key ERISA development. Because of our size, we provide what we consider to be a unique level of specific subject matter expertise that leverages our colleagues’ expertise in working at agencies like the PBGC, a number of our colleagues’ experience as actuaries and accountants, our industry-leading knowledge of ERISA and its prohibited transaction rules, and our experience with creating and investing in alternative investment products. In short, while there are always new developments, because of our industry leading knowledge base, we come equipped from the first moment to guide clients through the pension plan termination process and especially any challenges that emerge in this process.

¹ This Q&A is Part II of a two-part series. To read Part I, click here.

Rising Interest Rates

The first quarter of 2022 has seen a steep rise in interest rates. This increase in rates is across the board, with increases in short durations as well as long durations, treasuries as well as corporate bonds. While rising interest rates (aka discount rates) generally lead to lower defined benefit pension liabilities, the specific impact on pension liabilities is not necessarily that straightforward.

Comparison of Interest Rates

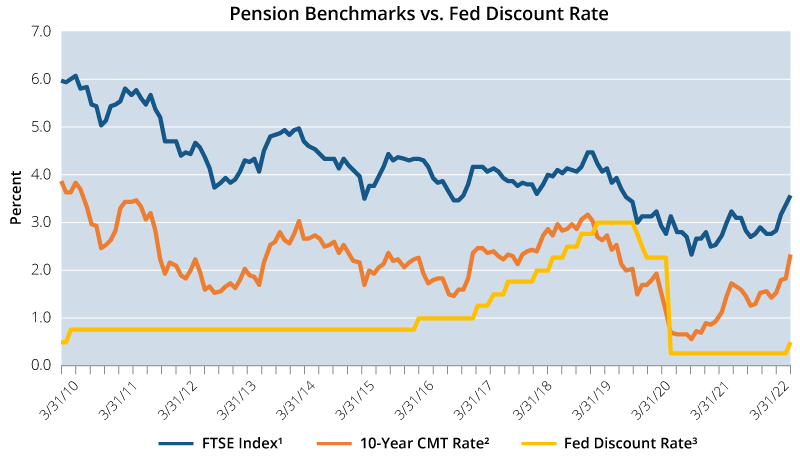

The Fed Discount Rate does not show a great correlation with long-term pension interest rates. Thus, the Fed’s anticipated rate hikes may not have the impact on pension interest rates that some plan sponsors expect.

Sources:

¹ Yieldbook.com, https://www.yieldbook.com/m/indices/FTSE-pension-liability.shtml, March 31, 2022

² 10-Year CMT Rate - Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, March 31, 2022.

³ Fed Discount Rate - International Monetary Fund, Interest Rates, Discount Rate for United States [INTDSRUSM193N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/INTDSRUSM193N, March 31, 2022.

Through the first quarter of 2022, The FTSE Pension Liability Index (“FTSE Index”) had risen over 70 basis points (up 32 bps in January, and 20 more in February and another 20 bps in March). In the table above, the FTSE Index has tended to move in much the same manner as the 10-Year Constant Maturity Treasury Rate (“10-Year CMT Rate”) – both of which may be referenced as a general guide for interest rates used to measure pension plans’ accounting or plan termination liability. In contrast, the Federal Reserve Discount Rate (”Fed Discount Rate”) has not moved in lockstep with these pension interest rate benchmarks.

While the Fed is expected to continue to increase rates, this won’t necessarily translate into decreased pension liabilities. Rate increases by the Fed typically correlate more with shorter duration interest rates, and some portion of rate increases may have already been factored into bond rates and indicators such as the FTSE Index.

Interest Rate Effect on Various Pension Plan Liabilities

While the FTSE Index and the related FTSE curve are widely used for pension accounting measurements, there are many different pension liabilities to consider – and each behaves differently with changing interest rates. Below are some different pension measurements, and the varying ways in which they are impacted by rising interest rates:

- Target Liability used for minimum funding requirements and AFTAP: The interest rates used for the Target Liability will decrease from 2022 to 2023. For minimum funding purposes, the Target Liability uses a 25-year averaging period for interest rates. Interest rates in 2022 are much lower than they were 25 years ago. As a result, the Target Liability interest rates are expected to drop each year for the foreseeable future, with the actual rise in today’s rates having very minimal impact.

- Accounting Liability (PBO, ABO, DBO): Accounting Liability is measured using current interest rates, as of the date of measurement. As a result, the rise in interest rates is expected to lower accounting liabilities, and (all else equal) lower the unrecognized loss within Accumulated Other Comprehensive Income (AOCI). Despite the lower Accounting Liability, the P&L expense will not necessarily be lowered, as the interest cost component of expense (for US GAAP) may be higher, due to the higher interest rates.

- Annuity Purchase Liability: Like accounting liabilities, the Annuity Purchase Liability (i.e., annuity purchase cost) depends on where interest rates stand on the day of the annuity purchase. Thus, today’s rising interest rates means that annuity purchase costs have decreased since the start of 2022.

- Lump Sum Liability: How interest rates will impact the Lump Sum Liability (i.e. lump sum cost) varies from plan to plan. Most commonly, pension plans will calculate lump sums based on interest rates at the end of the prior year. For instance, for a plan year that began on January 1, 2022, lump sums throughout the entirety of 2022 may be based on December 2021 interest rates, and thus would not be impacted at all by the recent spike in rates, until the 2023 plan year begins. Some plans (as specified in the official plan document) will allow the lump sums to be based upon interest rates that change quarterly or monthly. Thus, in the long run, these higher interest rates will lower lump sum payment amounts – though in the short term, not all lump sum payments will be lowered.

- PBGC Liability: The PBGC allows for either the “Standard Method”, or the “Alternative Method” to be used for purposes of determining a liability to be used for PBGC premium payment purposes. Under the Standard Method, the PBGC Liability will decrease as interest rates rise, as this method uses interest rates from the month prior to the measurement date. However, under the Alternative Method, interest rates are averaged over a 24-month period. Recent months have seen minimal change in rates (and even slight decreases) under the Alternative Method – the result would have been much worse had underlying rates not risen, but plan sponsors using the Alternative Method may be surprised to see little to no decrease in their plan’s PBGC Liability.

The stock market was generally down for the first three months of 2022. Losses in equity investments likely prevented most plans from realizing significant funded status gains as interest rates have risen. For plans heavily invested in a Liability Driven Investment (LDI) strategy, assets will have fallen as interest rates have risen, in order to maintain a stable funded status. But in any case, assets are likely down for just about all pension plans year-to-date. While this may not change a plan’s funded status much for accounting or annuity purchase purposes (and thus, potentially, plan termination), it will be harmful for minimum funding purposes, or for plans that are locked into the Alternative Method for PBGC premium calculations. There may still be many months before the next calculation of minimum funding Target Liability, or PBGC Liability is required, but it may be helpful for plan sponsors to understand how the recent rise in interest rates may affect these calculations moving forward.

As we’ve seen, interest rates can change very quickly. In fact, a similar increase (of 70 bps measured by the FTSE Pension Liability Index) occurred for the first quarter of 2021 – only to be followed by four months of declining rates. How these drastic changes in interest rates impact various pension calculations can be confusing and is sometimes counterintuitive. Plan sponsors may find it helpful to engage a qualified pension consultant like BCG Pension Risk Consultants I BCG Penbridge to help plan for next year and beyond.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 2.98%

Term Vesteds (duration of 10) – 3.11%

Actives (duration of 15) – 3.06%

Annuity Purchase Rates as of April 1, 2022