Due Diligence & Fiduciary Services

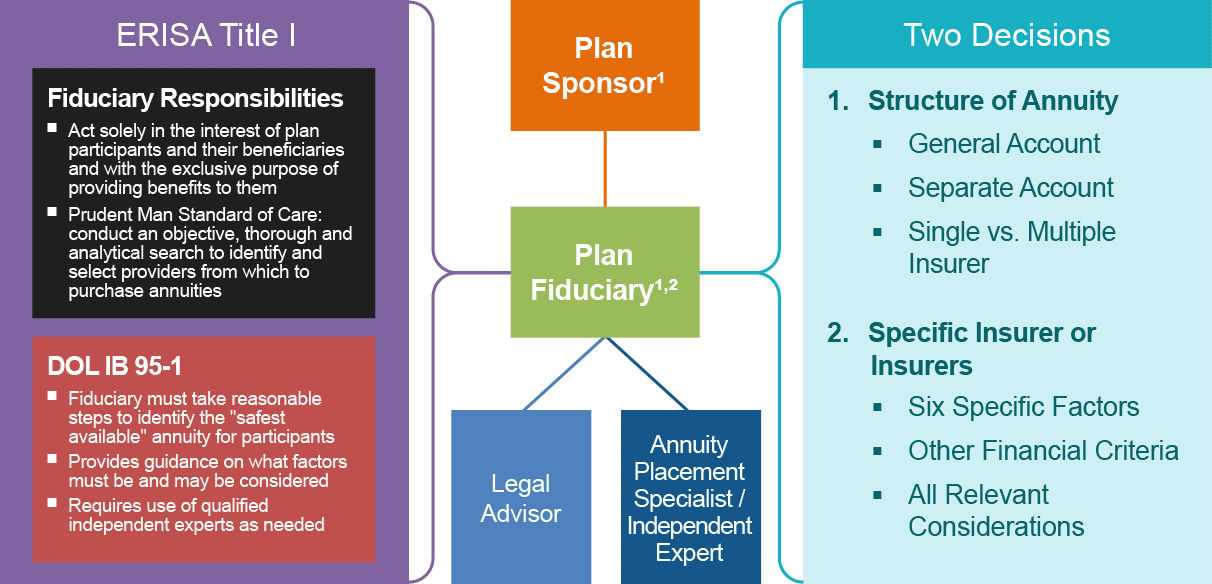

Our due diligence and fiduciary services include conducting the insurance company due diligence required by Department of Labor Interpretative Bulletin 95-1 (DOL IB 95-1) and serving our clients in a fiduciary capacity.

When BCG serves its clients as a fiduciary, we acknowledge in our Consulting Agreement and in our written report that we are acting in a fiduciary capacity. This is often referred to as acting in a co-fiduciary capacity because we are advising the in-house fiduciary. We are required to act in the best interest of the plan participants.

Depending on the in-house fiduciary’s preferred fiduciary structure, BCG can also serve in a sole-acting fiduciary capacity, whereby it makes the insurer selection.

For background, within the context of ERISA and DOL IB 95-1 guidance, the plan fiduciary must select an annuity structure and specific insurer or insurers.

¹ The Plan Sponsor is responsible for plan design “settlor” decisions; the fiduciary is responsible for implementation. These may be the same person wearing different “hats”.

² For annuity purchase cases above a certain size, ~$100M or even higher, the plan fiduciary may decide to engage a sole-acting independent fiduciary. The sole-acting independent fiduciary may or may not handle the DOL IB 95-1 analysis.

DOL IB 95-1 Considerations

Ratings and price alone will not ensure compliance with the fiduciary responsibilities of carrier selection. The failures of Executive Life and Confederation Life in the early 1990's are examples of highly rated companies going into receivership and retirees receiving less than the promised benefits.

The Department of Labor (DOL) has issued guidelines designed to help plan fiduciaries make sound financial decisions for their plan participants. DOL Interpretive Bulletin 95-1, issued in 1995, contains criteria that plan sponsors should consider when selecting an annuity provider and is still the most specific regulatory guidance for annuity purchase transactions. These include, but are not limited to:

- The quality and diversification of the annuity provider’s investment portfolio

- The size of the contract issuer relative to the proposed contract

- The level of the insurer's capital and surplus

- The annuity issuer's lines of business and other indications of the issuer's liability exposure

- The structure of the annuity contract and any guarantees supporting it

Additional safest available criteria that plan fiduciaries may consider include items such as:

- Asset-liability and liquidity management practices

- Use of derivatives

- Capital management, including risk-based ratios

- Earnings – quality, source

- Risk management practices

- Insurer Credit ratings

- Reinsurance – surplus relief; offshore

- Corporate culture

Other relevant considerations, e.g.:

- Administration capabilities of insurer

Top-rated Insurance Carriers

We monitor the annuity market on a daily basis. We work with all of the major pension annuity carriers and we research each company’s strengths and weaknesses carefully before recommending it as a source for annuities. We attend Insurance Carrier due diligence conferences, and make periodic visits to each carrier’s service center, to assure that each insurance carrier has a dedicated, quality service system in place to serve the participants and the plan’s needs.

Scope of services

BCG’s scope of services to support plan fiduciaries are as follows:

- Prepare and conduct fiduciary and annuity market training for plan fiduciaries as it relates to pension de-risking transactions;

- Serve as Independent Expert and provide full due diligence review as defined by DOL IB 95-1 in co-fiduciary capacity³;

- Work with plan’s investment advisors to coordinate the plan’s investment strategy with the plan’s risk transfer strategy (including ongoing customized buyout price monitoring in support of asset de-risking);

- Provide clear documentation that participants’ best interest was first in all decisions;

- Develop robust participant communication and education strategy; and

- If appropriate, serve as annuity market consultant in support of the plan fiduciary’s efforts to retain a sole-acting independent fiduciary.

³ BCG uses The ALIRT™ (AnaLysis of Insurer Risk Trends) Model, which is an industry-leading customized, comprehensive, insurance company solvency analysis and due diligence tool, designed for institutional clients monitoring their exposure to Life and Property & Casualty companies. ALIRT™ alerts us to insurers’ emerging financial trends, which may positively or negatively impact solvency.