The BCG Pension Insider

November 2021 – Volume 121, Edition 1

Addressing Alternative Assets in Defined Benefit Plan Terminations – Considerations for Plan Sponsors

With larger and more complex defined benefit (DB) plan terminations1 on the rise and continued growth in terminations in the U.S. pension risk transfer (PRT) market expected over the next decade, DB plan sponsors need to consider best practices for disposing their plan’s illiquid, alternative assets (e.g., private equity, real estate, hedge fund investments), if any, in the most cost-effective and timely manner.

Key considerations include:

- Preserving as much of a plan’s assets as possible to achieve the most cost-effective outcome at plan termination, hence reducing any plan sponsor funding requirements; and

- Ensuring a plan is, in fact, able to terminate given the limited or no appetite PRT insurers have for alternative assets as part of any asset-in-kind (AIK) transfer associated with annuity buyouts.

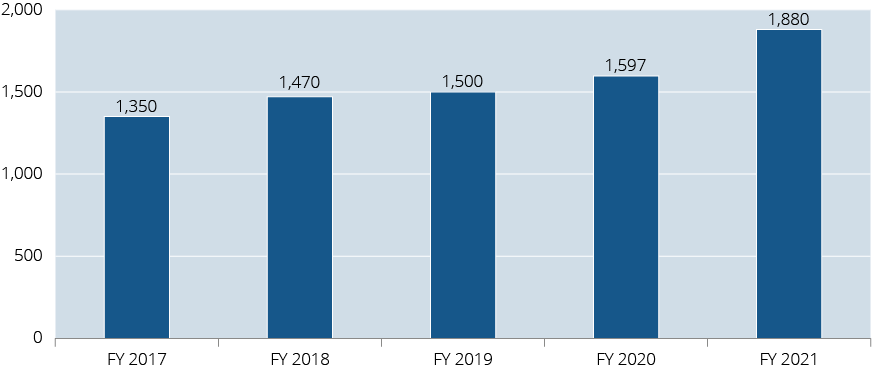

Total Number of Completed PBGC Standard Terminations – Last Five Fiscal Years2

A standard termination occurs when a sponsor of a PBGC insured defined benefit single-employer plan pays all the benefits it owes in a fully funded plan via insurance company annuities or lump sums pursuant to the standard termination requirements of ERISA.

Chart Commentary

- The PBGC FY 2021 Annual Report indicated seven large plans completed standard terminations. The PBGC defines large plans as having more than 35,000 participants.

- As in previous years, a very large percentage of FY 2021 plans that completed a standard termination were small plans that did not involve an annuity purchase, i.e., all participants elected to take their benefit as a lump sum distribution.

- Despite only seven large plan terminations in FY 2021, the PBGC has indicated it expects large plan terminations to increase.

Acceptable Assets

PRT insurers’ asset portfolios reflect their regulatory and surplus requirements, their mix of business and their willingness to assume risk. For portfolios backing annuity buyouts, this primarily consists of fixed income assets whose combined cash flows and duration are consistent with those of the buyout liability. It is typically quite similar to a full liability-driven investment strategy for a pension plan. Insurers typically have little or no appetite for certain types of assets, including many which are perfectly fine for an ongoing DB plan to hold. See below chart which includes a question and PRT insurer responses from BCG’s “2021 Survey of Asset-In-Kind Practices of Annuity Providers.”

| Which asset classes have you actually accepted for an AIK transfer? | Count (n=10) |

|---|---|

| Investment Grade Corporate Bonds | 9 |

| Treasury Securities (including STRIPS) | 8 |

| Agency Debentures | 7 |

| Municipal Bonds | 6 |

| High Yield Bonds | 4 |

| CMBS/ABS | 4 |

| Private Equity | 3 |

| Private Placement Bonds | 2 |

| Commercial Mortgages | 1 |

| Public Equity | 1 |

| Hedge Funds | 1 |

| Real Estate | 0 |

| Preferred Stock | 0 |

| Derivatives (to be novated) | 0 |

| Unit-linked / Pooled Funds | 0 |

| Other | 0 |

- Of the 10 PRT annuity providers who participated in the survey and completed an AIK transfer, they primarily accepted fixed income assets. Only three insurers accepted private equity, one accepted hedge funds, and no insurers accepted real estate or “other” assets as part of an AIK annuity purchase.

The above survey results are crucial for plan sponsors in terms of understanding the importance of addressing their plan’s alternative assets (again, if any) as early as possible when termination of their DB plan becomes the “endgame” objective. If addressed too late, or not at all, plan sponsors will likely find little or no interest from PRT insurers and/or face taking more significant haircuts to net asset values than would otherwise be the case with proper lead times and due diligence. And worst case, the plan sponsor may be unable to terminate the plan. In this situation, the plan sponsor would be faced with unwinding the termination (which can be very challenging from a regulatory perspective as filings and notifications which are required while a plan is ongoing have been discontinued during the termination process) and communicating the termination cancellation to all stakeholders, including the IRS, PBGC and plan participants.

Planning Ahead

The secondary market refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds.

There could also be more appetite from PRT insurers for alternative assets in the future as larger plan terminations come to market, whereby transferring alternative asset holdings to insurers becomes more common. In fact, many insurers already participate in some of these alternative asset classes, they just typically are originating on their own or through a third-party manager. But when it comes to PRT annuity placements, these transfers require much more foresight and lead time than a typical AIK transfer for publicly priced securities and don’t fit in the standard 1-2 month annuity placement project. Yet another option is for the employer/plan sponsor to purchase the alternative asset(s) from the plan through a Department of Labor prohibited transaction exemption. This can be a long process with no guarantee of approval but could also be considered. Whatever path or solution the plan sponsor chooses, addressing alternative assets well in advance of starting a DB plan’s termination process is critical.

Athene and Fidelity & Guaranty Commence Participation in BCG’s Monthly Annuity Buyout Pricing Survey

Athene Holding Ltd.3 (“Athene”) and Fidelity & Guaranty (“F&G”) are now participating in BCG’s monthly annuity buyout pricing survey, effective this month.

Athene entered the US Pension Risk Transfer (“PRT”) market in 2017 and, as of November 3, 2021, has closed 30 PRT transactions totaling approximately $28 billion in assumed liabilities and covering more than 390,000 participants. Through its subsidiaries, Athene has become a leader in the PRT market, with a track record of completing large-scale transactions that help plan sponsors meet their pension obligations while providing income security for their plan participants and their spouses and beneficiaries. Athene specializes in helping its customers achieve financial security and is a solutions provider to institutions. Through its subsidiaries, Athene has been serving corporate and retail customers for over a century with policyholder protection as its top priority.

F&G entered the US PRT market in the second quarter of 2021 and has had a strong start year-to-date, writing PRT annuities across multiple transactions as of 10/31/2021. F&G is part of the FNF family of companies. F&G is committed to helping Americans turn their aspirations into reality. F&G is a leading provider of annuity and life insurance products and is headquartered in Des Moines, Iowa.

In total, there are 19 PRT insurers currently active in the market, with eleven new entrants since 2014. Of the 19 insurers, 13 are now participating in BCG’s monthly pricing survey. Other participating insurers include AIG, Legal & General, MassMutual, MetLife, Mutual of Omaha, OneAmerica, Pacific Life, Principal, Prudential, Securian Financial and Western & Southern.

BCG uses the rates gathered in its survey to estimate annuity buyout pricing as part of its PRT Analysis service to help clients set PRT strategy and to provide ongoing monitoring of annuity pricing for its clients via its Customized Buyout Price Monitoring (CBPM) service and also to compile the BCG PRT Index, which is the longest standing pension buyout index in the United States. The Index provides an easy comparison of annuity pricing to various important pension liability measures.

- 1 Plan termination is the only method permitted by ERISA to remove an entire DB plan from the corporate balance sheet.

- 2 Source: PBGC Annual Reports.

- 3 Contracts are issued by Athene Annuity and Life Company, West Des Moines, IA, in all states (except New York), and in D.C. and PR. For New York residents, contracts are issued by Athene Annuity & Life Assurance Company of New York, Pearl River, NY. Payment obligations and guarantees are subject to the financial strength and claims-paying ability of the issuing insurance company. Products may not be available in all states.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 2.00%

Term Vesteds (duration of 10) – 2.14%

Actives (duration of 15) – 2.19%

Annuity Purchase Rates as of November 1, 2021