The BCG Pension Insider

January 2024 – Volume 147, Edition 1

BCG Thought Leadership 2023 Roundup, Three Pension De-Risking Market Predictions for 2024 and A Tip of the Hat

BCG thought leadership addresses topics relevant to the U.S. pension de-risking market, leveraging BCG’s leadership position to share its insights and perspectives, as well as those of other pension industry experts.

Happy New Year! In this first featured article of 2024, we are taking a look back at the articles, surveys, spotlight series Q&A interviews, etc. that BCG Pension Risk Consultants I BCG Penbridge (“BCG”) authored and/or collaborated on in 2023 in its highly followed industry newsletter, The BCG Pension Insider. We also make three pension de-risking market predictions for 2024 and tip our hat and say thank you.

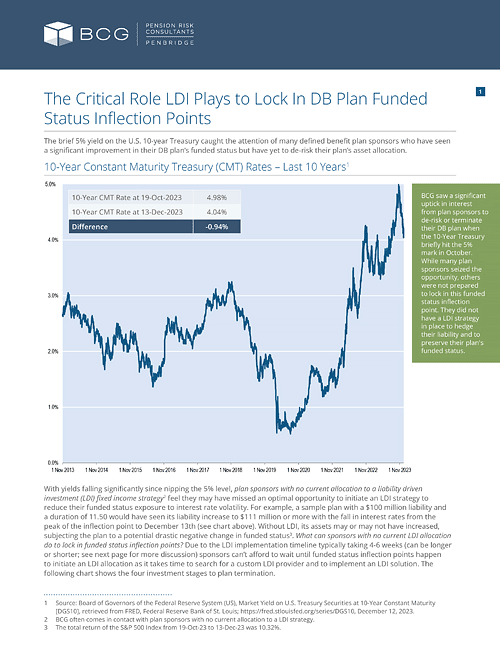

The Critical Role LDI Plays to Lock In DB Plan Funded Status Inflection Points | 12.2023

There was a significant uptick in interest from plan sponsors to de-risk or terminate their defined benefit plan when the 10-Year Treasury briefly hit the 5% mark in October. While many plan sponsors seized the opportunity, others were not prepared to lock in this funded status inflection point. They did not have a liability driven investment (“LDI”) strategy in place to hedge their liability and to preserve their plan’s funded status. This article encourages plan sponsors with no current LDI strategy to put in place an LDI strategy, so their DB plan is positioned to lock in funded status inflection points when they happen as the “windows” for optimal de-risking are often fleeting.

Spotlight Series Q&A with MetLife – Top Trends in Today’s Rapidly Growing US Pension Risk Transfer Market | 11.2023

Elizabeth Walsh, VP, Head of US Pensions at MetLife, discusses MetLife’s market-leading pension risk transfer business and the trends in today’s growing market. In addition, Elizabeth shares insights on insurer capacity as well as transaction timing, reinsurance and the potential for more jumbo deals in the coming years.

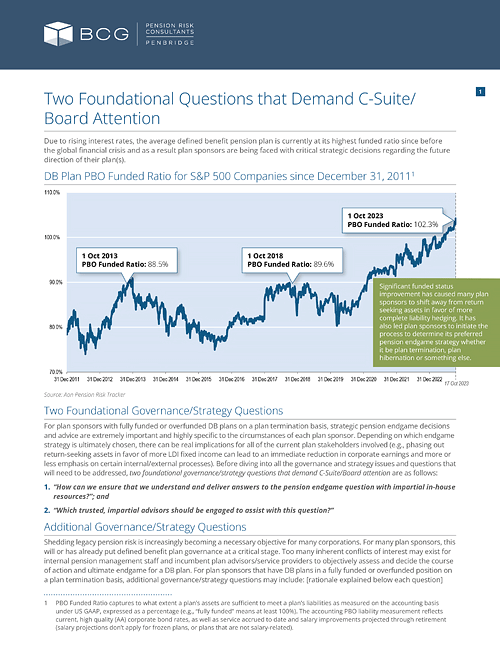

Two Foundational Questions that Demand C-Suite/Board Attention | 10.2023

Significant funded status improvement for defined benefit pension plans has caused many plan sponsors to shift away from return seeking assets in favor of more complete liability hedging. It has also led plan sponsors to initiate the process to determine its preferred pension endgame strategy whether it be plan termination, plan hibernation or something else. With this backdrop in mind, this article identifies two foundational governance/strategy questions that demand C-Suite/ Board attention as well as additional governance/strategy questions that can help plan sponsors avoid potential conflict of interest issues surrounding the future direction of their DB plan(s).

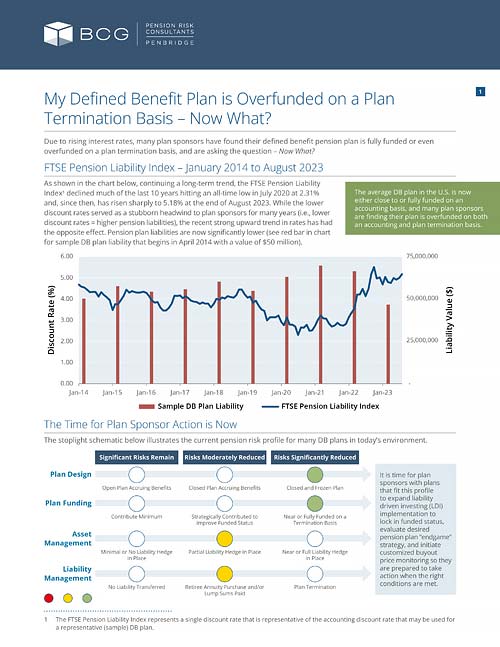

My Defined Benefit Plan is Overfunded on a Plan Termination Basis – Now What? | 09.2023

This article is a call to action for plan sponsors with fully funded or even overfunded defined benefit plans on a plan termination basis to expand liability driven investing (“LDI”) implementation to lock in funded status, evaluate desired pension plan “endgame” strategy, and initiate customized buyout price monitoring so they are prepared to take action when the right conditions are met. A plan sponsor “should do” list is provided as well as a step-by-step guide to prepare the asset portfolio for plan termination and a summary on what plan sponsors can do with a pension surplus.

Spotlight Series Q&A with F&G – Navigating Mortality Risk: The 9-Digit Zip Code Advantage in Pension Risk Transfer Annuities | 08.2023

Jay Dinunzio, VP at F&G, provides an introduction to F&G’s growing pension risk transfer business and discusses the critical role that assessing pensioner mortality plays in the PRT pricing process. Additionally, Jay highlights the importance of 9-digit Zip Code information and touches on how F&G has taken pandemic mortality into consideration when evaluating mortality experience and improvement.

Spotlight Series Q&A with Ortec Finance – The Importance of Looking Ahead for Defined Benefit Plan Sponsors | 07.2023

Ton Van Welie, CEO at Ortec Finance, provides an introduction to Ortec Finance’s business, describes how he and his team help many of the largest institutional investors in the world make complex financial decisions, and provides his insights on why defined benefit pension plans may want to reduce risk in the current market environment, with particular emphasis on well-funded DB plans.

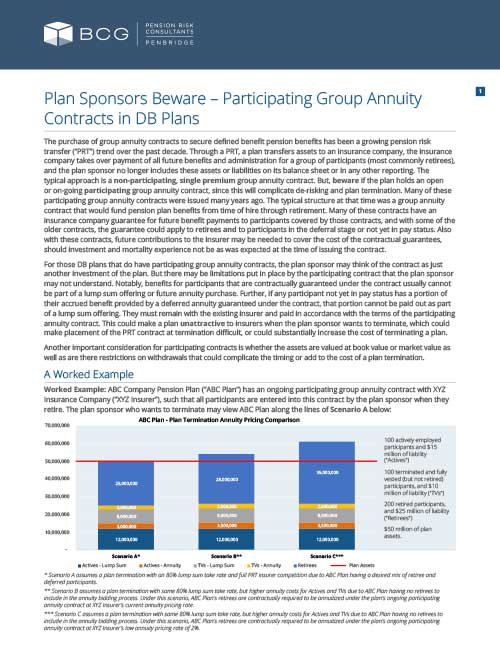

Plan Sponsors Beware – Participating Group Annuity Contracts in DB Plans | 06.2023

This article discusses participating annuity contracts in DB plans, and why plan sponsors need to beware if their plan holds an open or on-going participating group annuity contract, since this will complicate de-risking and plan termination. This article includes a worked example, discusses why plan sponsors entered into participating contracts and what can be done. It is crucial that the plan sponsor understands early on the implications of discontinuing or terminating a participating contract on the ultimate cost of plan termination, and/or the cost implications that can make a plan termination prohibitively expensive.

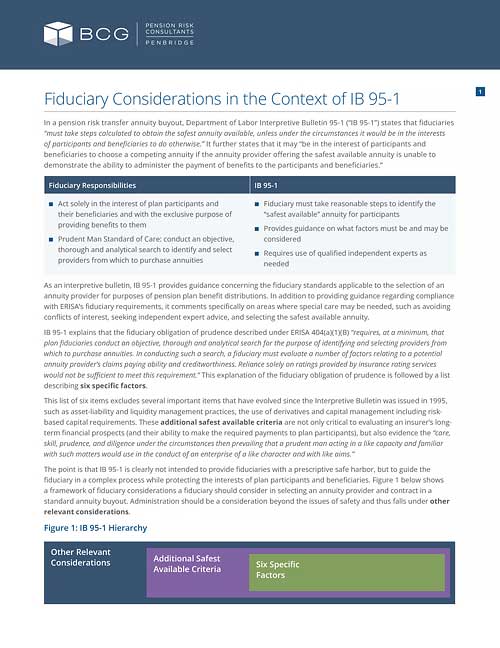

Fiduciary Considerations in the Context of IB 95-1 | 05.2023

This article discusses fiduciary considerations in the context of Department of Labor Interpretive Bulletin 95-1 (“IB 95-1”), including a framework a fiduciary should consider in selecting an annuity provider and contract in a pension risk transfer annuity buyout. The article also discusses Administration, its relevance under IB 95-1 and takes a deeper dive into key administration factors, including major administration considerations and why they are important.

Spotlight Series Q&A with Goldman Sachs Asset Management – Why Conditions Remain Ripe for Pension De-Risking | 04.2023

Michael Moran, CFA, Managing Director – Client Solutions at Goldman Sachs Asset Management, discusses that while corporate defined benefit pension plans are enjoying their highest funded levels in 15 years, now is not the time for sponsors to be lulled into complacency.

Spotlight Series Q&A with NISA Investment Advisors – Breaking Down the Hibernation vs. Termination Decision | 03.2023

David Eichhorn, CFA, Chief Executive Officer and Head of Investment Strategies at NISA Investment Advisors, discusses de-risking strategies among corporate plan sponsors. This includes a framework for thinking about hibernation and annuitization tradeoffs. Additionally, he provides thoughts on how plan sponsors can use a market-based approach to compare relative risk between insurance companies.

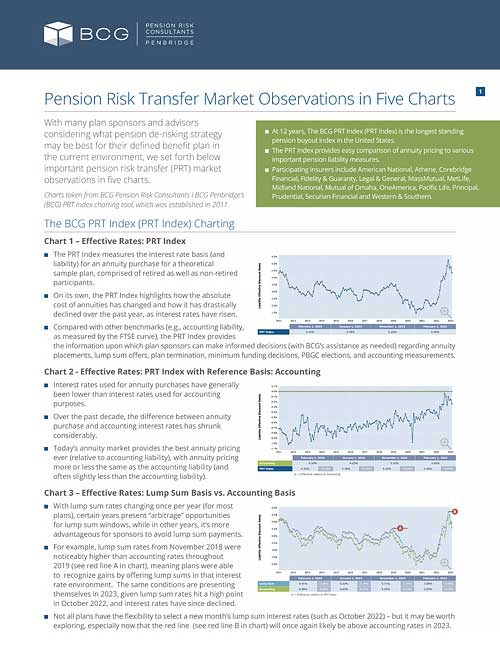

Pension Risk Transfer Market Observations in Five Charts | 02.2023

With many plan sponsors and advisors considering what pension de-risking strategy may be best for their defined benefit plan in the current environment, this article identifies and explains important pension risk transfer (PRT) market observations in five charts.

Charts taken from BCG Pension Risk Consultants I BCG Penbridge’s (BCG) PRT Index charting tool, which was established in 2011.

Spotlight Series Q&A with Ivins, Phillips & Barker: Fiduciary Considerations for an Expanding U.S. Pension Risk Transfer Market | 01.2023

Kevin P. O’Brien, Partner in Ivins, Phillips & Barker’s Employee Benefits and Executive Compensation practice, shares his insights on the legal and fiduciary aspects of PRT transactions, including several legal tidbits that all plan fiduciaries considering a PRT annuity transaction should know.

Three Pension De-Risking Market Predictions for 2024

Prediction #1: Earlier action for plan terminations and retiree lift-outs

- Plan administrator and insurer capacity (human capacity, not financial/capital) issues arose during 2023, leaving some plans unable to complete a plan termination on their desired timetable, and others not receiving the expected (insurer) interest, especially during Q4. As a result, we expect Q1 and Q2 of 2024 to be busier than usual, as plans that were unable to complete transactions at the end of 2023 seek to complete their plan terminations or retiree lift-outs at the earliest opportunity in 2024. Any plan sponsors just starting the annuity purchase process should be taking into account potential capacity issues at year-end. They are well advised to both take action a bit sooner in the year and build in some timing flexibility should unique circumstances arise to increase the likelihood of achieving the most optimal result. For plan terminations where illiquid alternative assets are part of the plan’s asset mix, even earlier action is needed to dispose of these assets at the best possible pricing levels and to avoid any unduly large haircuts.

Prediction #2: More lump sums

- Much like the 2023 plan year (when high interest rates from late 2022 created favorable lump sum opportunities), high interest rates from late in 2023 combined with a recent and significant drop in those interest rates should lead to many plans looking at the potential savings available by offering a lump sum window in 2024. Given this is not the first instance for this interest rate scenario, again there were similar conditions last year, many plans have already exhausted the savings available via lump sums. But those plans who have not yet offered such a lump sum window (or did so a few years back) may want to take advantage of the savings that can be achieved. Plan sponsors may also be looking into offering lump sums to retirees, or to older (age 59.5+) active employees, especially if interest rates continue to fall.

Prediction #3: Continuous monitoring, ongoing consulting becomes critical

- An important lesson learned from 2023 is just how quickly things can change. The high interest rates from October of 2022 had plummeted down early in 2023, only to rise beyond the previous year’s high by October 2023 – with a subsequent crash in interest rates over the past two months. The shifting interest rate (and annuity purchase) market from 2023 reminded us just how quickly and drastically things can change. Opportunities often present themselves to offer lump sums, borrow at low interest rates, terminate a plan in an attractive environment, lock in a favorable funded status with liability driven investing, or implement a buy-in solution that effectively locks in the cost at the beginning rather than the end of the plan termination process – but these opportunities are often short-lived and disappear quickly. Plan sponsors who routinely monitor their plan’s funded status (e.g., monthly) and have engaged pension de-risking consultants who bring an independent perspective ready to present them with opportunities will be able to take advantage of these opportunities, while those that take a more laissez-faire approach to their plan’s de-risking strategy may miss out on the chance to save (literally) millions of dollars.

Bottom line

- Pension de-risking will continue at a rapid pace in 2024, but a more strategic, consultative, fast-acting (prepare in advance) approach will need to be adopted by plan sponsors to successfully navigate market volatility, optimally reduce risk, achieve desired pricing and timing outcomes and save significant dollars.

A Tip of the Hat

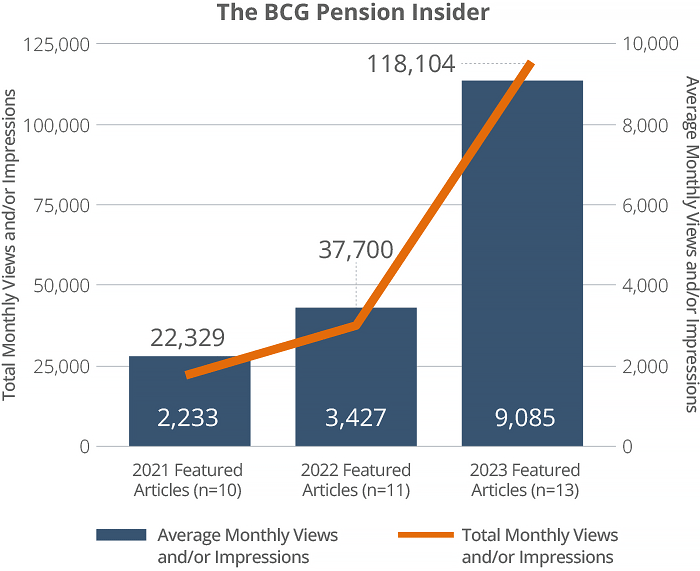

Our efforts beginning in 2021 to author and publish our own BCG branded thought leadership to address topics relevant to the U.S. pension de-risking market, leveraging BCG’s leadership position to share its insights and perspectives, as well as those of other pension industry experts saw a “hockey stick” change in results this past year.

In 2023, the articles featured in this Roundup had 118,104 views and/or impressions in BCG’s newsletter that we distribute via email and on social media, an average of 9,000+ views and/or impressions per month. This compares to 37,700 views and/or impressions (an average of 3,400+ per month) in 2022 and 22,329 views and/or impressions (an average of 2,200+ per month) in 2021. How did we achieve these results? Two ways (1) the feedback on our featured articles has been exceptional regarding the consistent, collaborative, thoughtful approach and (2) our relationships with all of the players in the pension de-risking ecosystem have provided a powerful network effect.

For example, the industry leaders and companies we showcase in the BCG Spotlight Series Q&A’s are increasingly deciding to distribute the Q&A’s via their own LinkedIn post on their own individual and company LinkedIn pages. This network sharing has dramatically increased the “eyeballs” seeing BCG’s thought leadership each month. For this – we tip our hat and say thank you!

For example, the industry leaders and companies we showcase in the BCG Spotlight Series Q&A’s are increasingly deciding to distribute the Q&A’s via their own LinkedIn post on their own individual and company LinkedIn pages. This network sharing has dramatically increased the “eyeballs” seeing BCG’s thought leadership each month. For this – we tip our hat and say thank you!

Our growing readership is comprised of plan sponsors, plan advisors, consulting actuaries, institutional investment consultants, asset managers, law firms, PRT insurers, reinsurers, as well as other pension industry participants. You can refer a friend or colleague to sign up to The BCG Pension Insider monthly newsletter by sending this link – bcgpension.com/sign-up

How Can BCG Help

To learn more or drill down further on any of the topics covered in BCG’s articles, or to discuss our three pension de-risking market predictions for 2024, please contact us.

Contact Us

Steve Keating, Managing Director

BCG Pension Risk Consultants | BCG Penbridge

T: 203-955-1566

E: skeating@bcgpension.com

LinkedIn

BCG Snapshot

- Founded in 1983

- Senior team averages 28 years’ experience in the defined benefit and/or annuity placement market

- Total ten-year annuity placement transaction premium volume was $7.2 billion across 522 annuity placements for period ending 12/31/23

- 12% annuity placement market share by number of transactions for ten-year period ending 12/31/23, including 85 completed annuity placement transactions in 2023¹

- 100% of firm revenue comes from pension risk consulting, comprehensive implementation support and related services, singularly focused on driving strategic pension outcomes

- Pension de-risking market innovator responsible for several industry firsts

¹ Reflects an unofficial estimate of 700 annuity placement transactions in 2023.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 4.55%

Term Vesteds (duration of 10) – 4.54%

Actives (duration of 15) – 4.47%

Annuity Purchase Rates as of January 1, 2024