The BCG Pension Insider

December 2023 – Volume 146, Edition 1

The Critical Role LDI Plays to Lock In DB Plan Funded Status Inflection Points

The brief 5% yield on the U.S. 10-year Treasury caught the attention of many defined benefit plan sponsors who have seen a significant improvement in their DB plan’s funded status but have yet to de-risk their plan’s asset allocation.

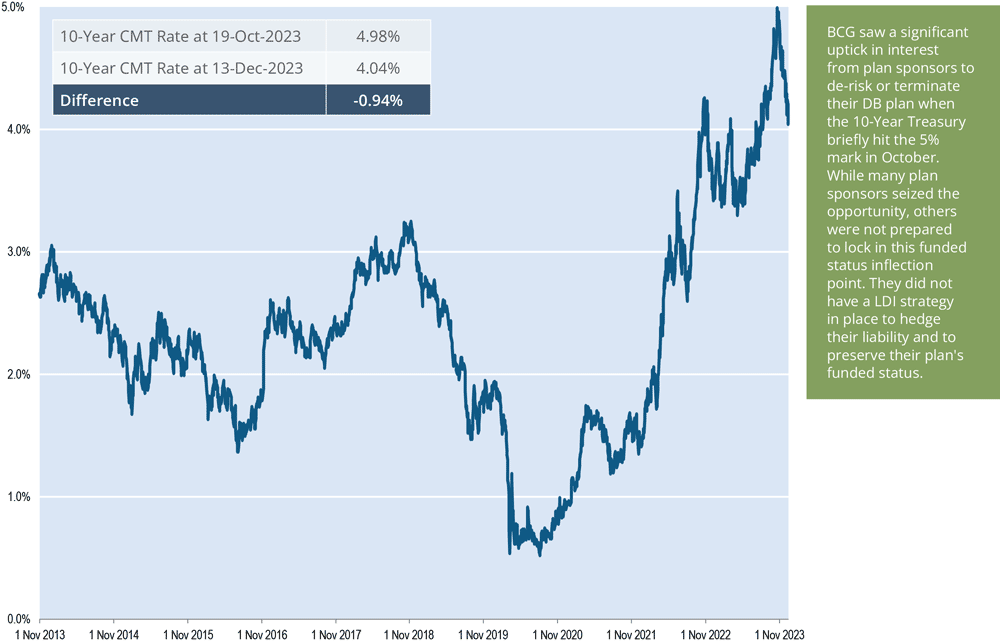

10-Year Constant Maturity Treasury (CMT) Rates – Last 10 Years1

With yields falling significantly since nipping the 5% level, plan sponsors with no current allocation to a liability driven investment (LDI) fixed income strategy2 feel they may have missed an optimal opportunity to initiate an LDI strategy to reduce their funded status exposure to interest rate volatility. For example, a sample plan with a $100 million liability and a duration of 11.50 would have seen its liability increase to $111 million or more with the fall in interest rates from the peak of the inflection point to December 13th (see chart above). Without LDI, its assets may or may not have increased, subjecting the plan to a potential drastic negative change in funded status3. What can sponsors with no current LDI allocation do to lock in funded status inflection points? Due to the LDI implementation timeline typically taking 4-6 weeks (can be longer or shorter; see next page for more discussion) sponsors can’t afford to wait until funded status inflection points happen to initiate an LDI allocation as it takes time to search for a custom LDI provider and to implement an LDI solution. The following chart shows the four investment stages to plan termination.

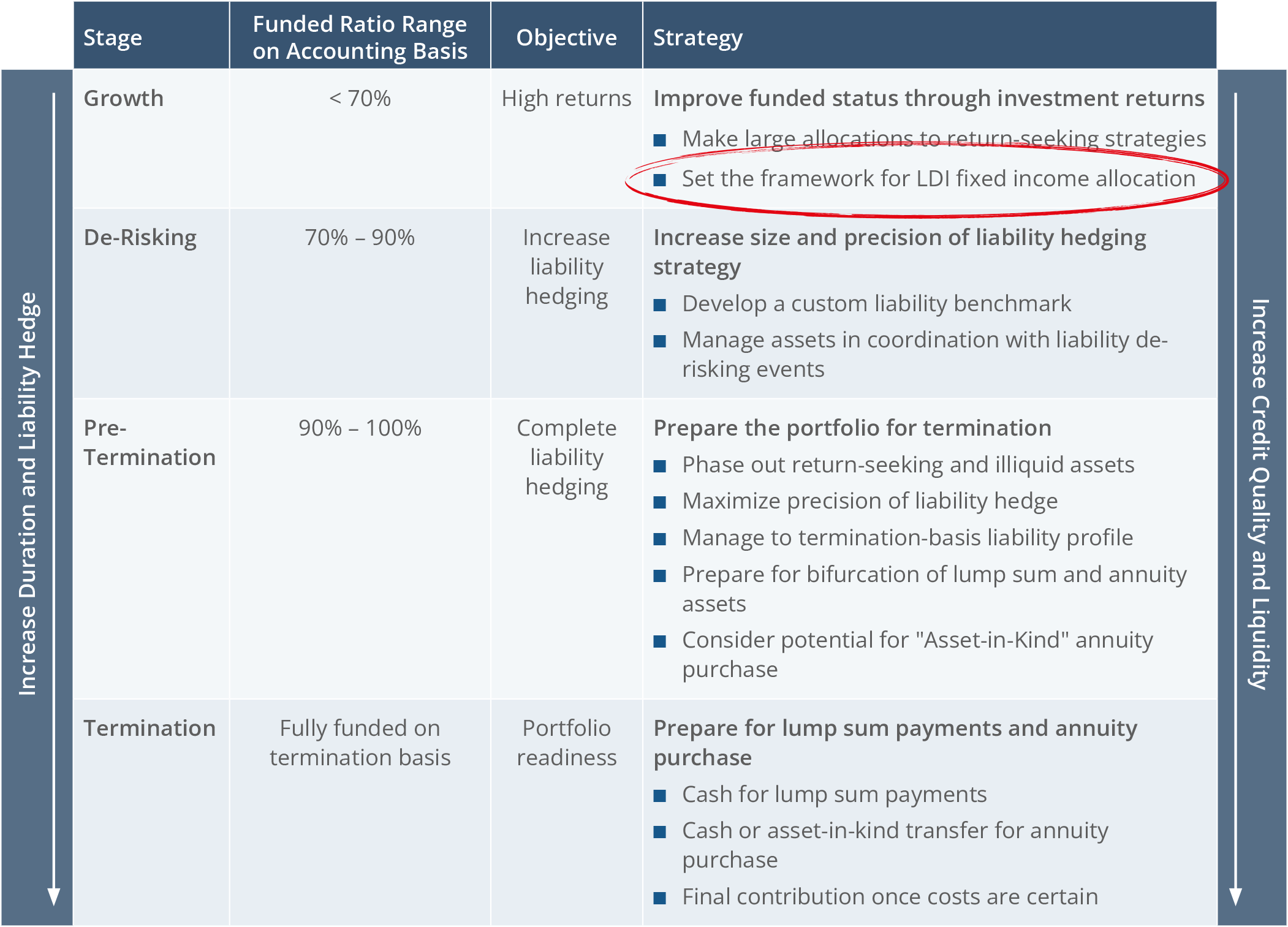

Four Investment Stages to Plan Termination

The chart above shows that plan sponsors ideally should set the framework for their plan’s LDI allocation during the plan’s growth stage. The growth stage funded ratio range on the accounting basis is ⟨70%. Given most DB plans today have funded ratios above 90% on an accounting basis with many plans close to or fully funded, the objective for these plans has moved to complete liability hedging. For those sponsors with no current allocation to an LDI strategy and plan termination is the “endgame” objective, the time is now to embark on a search to select an LDI manager who can build a LDI solution for their DB plan. Most importantly, when their DB plan funded ratio hits an inflection point, they will be positioned to seize the opportunity.

LDI Implementation Timeline

Below are common steps to set up an allocation to a custom LDI solution4. This process generally takes 4-6 weeks and many of these steps are happening simultaneously:

- Client completes IMA and sends LDI Manager applicable supporting documentation (W9, trust agreement, authorized signors, etc.)

- LDI Manager creates and establishes custom LDI benchmark

- Client completes Custodian paperwork

- LDI Manager and Custodian work to set up required client linkage

- LDI Manager completes “Know Your Customer” review

- LDI Manager sets up Client account on systems, trading begins

While LDI managers strive to expedite new client onboarding as much as possible, the process by its nature involves several different parties and, often, multiple individuals and departments within organizations. Plan sponsors with no current LDI strategy should be working with their plan advisor/consultant to put in place an LDI strategy so their DB plan is positioned to lock in funded status inflection points when they happen as the “windows” for optimal de-risking are often fleeting.

How BCG Can Help

BCG brings a unique level of service to its clients and a much-needed independent perspective. Our dedication and focus on pension risk consulting and PRT implementation provides an integrated, one-stop solution for employers looking to address and manage the risks involved in their pension programs. BCG helps clients with the full range of pension de-risking strategies from LDI approaches to partial or full PRT, with particular expertise navigating the complex and lengthy process of plan termination. BCG frequently works in collaboration with plan advisors, consulting actuaries, institutional investment consultants, asset managers and law firms and has established working relationships with all of the insurers that participate in the U.S. PRT industry.

Contact Us

Steve Keating, Managing Director

BCG Pension Risk Consultants | BCG Penbridge

T: 203-955-1566

E: skeating@bcgpension.com

LinkedIn

1 Source: Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; fred.stlouisfed.org/series/DGS10, December 12, 2023.

2 BCG often comes in contact with plan sponsors with no current allocation to a LDI strategy.

3 The total return of the S&P 500 Index from 19-Oct-23 to 13-Dec-23 was 10.32%.

4 A custom LDI solution represents a mix of treasury bonds and individual credit securities that match a plan’s liability and forms the basis for investing the portfolio and performance measurement. It is also suitable for a future potential asset-in-kind transfer to insurers.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 4.95%

Term Vesteds (duration of 10) – 4.96%

Actives (duration of 15) – 4.89%

Annuity Purchase Rates as of December 1, 2023