The BCG Pension Insider

August 2022 – Volume 130, Edition 1

Technical Impediments to Pension De-Risking

The trend of increased pension de-risking has been clear over the last decade. 2021 was a record year in the annuity market, with over $38 billion of buyouts and buy-ins recorded. While continued busy years in the annuity market certainly lie ahead, there are technical impediments that some plans will face that will prevent them from taking de-risking action(s) while the iron is hot. Identifying and addressing these hurdles may allow for plan sponsors to optimally de-risk sooner rather than later, taking advantage of the attractive annuity pricing that so many other pension plans have benefited from in recent years.

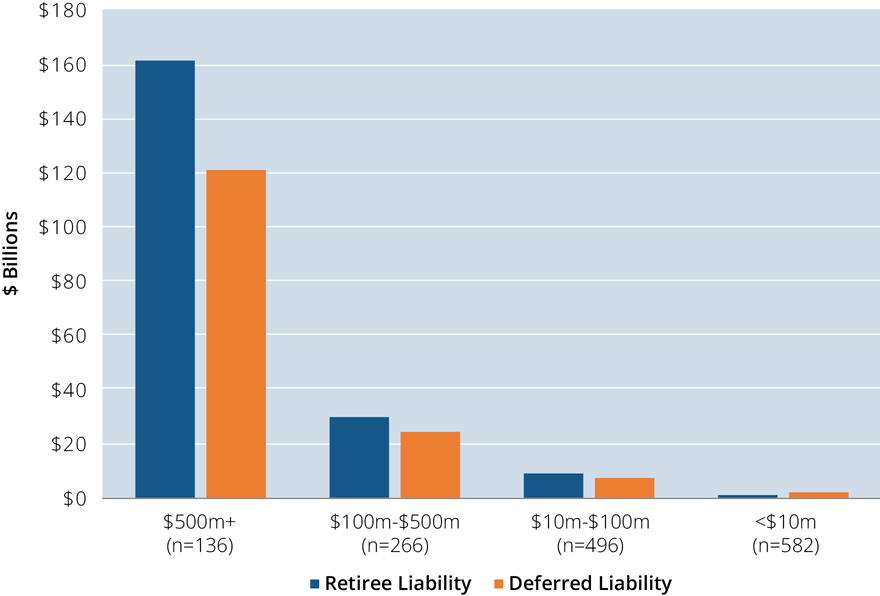

Fully Funded and Frozen Plans by Size and Participant Status¹

As indicated by the chart, significant pension liability remains. This chart shows that over $200B of Retiree Liability alone remains in ongoing plans that are already frozen and fully funded. Without impediments to annuitization, it would be logical that most of the $200B of retirees, plus a portion of the $154B Deferred Liability would be de-risked and transferred to insurance companies in the near future.

Settlement Accounting

Perhaps the most common impediment to pension de-risking that exists for U.S. pension plans is the albatross of the Unrecognized Loss that lies within Accumulated Other Comprehensive Income (“AOCI”) for many (most) plans that are accounted for under U.S. GAAP². Over the life of most pension plans, interest rates have fallen, and longevity (i.e., life expectancy) has improved. Many pension plans have also failed to achieve the return on assets that they have targeted (via the Expected Return on Assets, or EROA, component of the pension expense calculation). These, together with a myriad of other sources of gains and losses, have left most plans with a sizable Unrecognized Loss in AOCI.

Year after year, a small piece of this Unrecognized Loss will move from AOCI into the annual pension expense. But in years where Settlement Accounting is triggered, a much larger portion of this Unrecognized Loss must be moved into the current year’s expense. This added expense often has not been planned for – and even if it can be anticipated, it is often an expense that plan sponsors are unwilling to accept. Thus, pension de-risking is perpetually delayed or said another way, the can is kicked down the road.

EROA Assumption

Pension Expense Example³

| Service Cost: | $1,000,000 |

| Interest Cost: | $4,000,000 |

| EROA: | ($8,000,000) |

| Loss Amortization: | $3,000,000 |

| Total Pension Expense: | $0 |

Another somewhat related accounting consideration that will prevent some plan sponsors from de-risking (or will limit their pension de-risking activities) is the EROA Assumption. Plan sponsors, together with their investment advisors and actuary, will arrive at an assumed rate of return that their assets will achieve over the long run. A higher future return assumption allows for smaller expense in the current year. But if the high returns are not achieved, the shortfall adds to the Unrecognized Loss discussed above. However, some sponsors have come to rely on a high EROA, since this piece of the expense calculation keeps their overall pension expense low. By shifting significant assets out of the plan, they limit their ability to have the EROA component lower their annual pension expense. This consideration may limit both a plan sponsor’s desire to de-risk the plan through permanent actions (such as lump sum payments or annuity purchases), but may also limit a plan sponsor’s willingness to invest in Liability Driven Investments (“LDI”). LDI protects a plan’s funded status, but it does so by giving up potential superior future asset returns, and without the possibility of superior future asset returns, the EROA component of the expense must be lowered.

How Can BCG Help

What steps can be taken to remove these concerns, and allow a plan sponsor to de-risk their pension plan without negative accounting implications? Unfortunately, there is no simple solution. Understanding the mechanics of settlement accounting can be important to prepare for higher expense(s) and avoid last minute surprises. Accelerating the recognition of unrecognized losses can, over time, help to reduce the settlement impact. This may be done by removing the 10% corridor often used in the expense calculation, using a shorter amortization period when recognizing losses, or being more conservative on a plan’s assumptions (notably the EROA assumption). One more extreme approach would be to move to a “mark-to-market” accounting approach, where gains and losses are recognized as they happen. But ultimately, this becomes a matter of accepting a slightly higher annual expense starting now in order to avoid a potentially unavoidable and/or unexpected large expense in the future.

BCG’s Pension Risk Transfer (“PRT”) Analysis would be an initial step towards identification of these technical impediments, and possible paths forward. To request a sample PRT Analysis and/or to initiate discussions with BCG about your pension plan, please contact Steve Keating at skeating@bcgpension.com.

¹ Source: Pension Benefit Guaranty Corporation

² The accounting issues discussed herein do not apply under International Accounting Standards (IAS 19R), as unrecognized losses and the ability to reset the EROA component to reduce expense have been removed from IAS 19R.

³ It may be important to note that Accounting Standards Update 2017-7 (ASU-2017-7) changed the presentation of accounting pension expense. This update should be fully implemented for all plans at this time, as the latest year to start reflecting this update was the fiscal year starting after December 15, 2019. The result of ASU-2017-7 is that all components of pension expense except for the Service Cost are reported as non-operating expenses.

Stanford’s EPGC - A Transformational Experience for BCG’s Steve Keating

BCG’s Steve Keating recently participated in and completed the Stanford Graduate School of Business Executive Program for Growing Companies (“EPGC”) from July 31st - August 11th. The program comprised 78 participants from 35 countries. See the pin map below for geographical locations of EPGC 2022 participants -- a powerful visual that highlights the rich diversity in the program.

In commenting on his participation, Steve Keating says:

“The Stanford EPGC program was amazing. I was able to meet and work with program participants from around the world, all of them CEOs, Leaders, Founders and Entrepreneurs from an incredibly vast range of industries. Additionally, I had the opportunity to learn from Stanford's world class faculty, including strategies to move faster, operate more efficiently, expand into new markets and create strong cultures. I developed so many valuable new friendships and collaborators for the future, it was truly a transformational experience.”

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 3.84%

Term Vesteds (duration of 10) – 3.89%

Actives (duration of 15) – 3.94%

Annuity Purchase Rates as of August 1, 2022