The BCG Pension Insider

September 2023 – Volume 143, Edition 1

My Defined Benefit Plan is Overfunded on a Plan Termination Basis – Now What?

Due to rising interest rates, many plan sponsors have found their defined benefit pension plan is fully funded or even overfunded on a plan termination basis, and are asking the question – Now What?

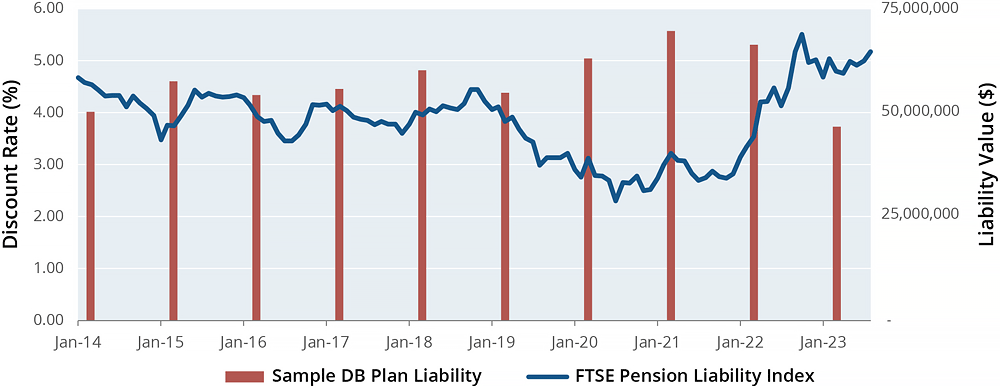

FTSE Pension Liability Index – January 2014 to August 2023

As shown in the chart below, continuing a long-term trend, the FTSE Pension Liability Index1 declined much of the last 10 years hitting an all-time low in July 2020 at 2.31% and, since then, has risen sharply to 5.18% at the end of August 2023. While the lower discount rates served as a stubborn headwind to plan sponsors for many years (i.e., lower discount rates = higher pension liabilities), the recent strong upward trend in rates has had the opposite effect. Pension plan liabilities are now significantly lower (see red bar in chart for sample DB plan liability that begins in April 2014 with a value of $50 million).

The Time for Plan Sponsor Action is Now

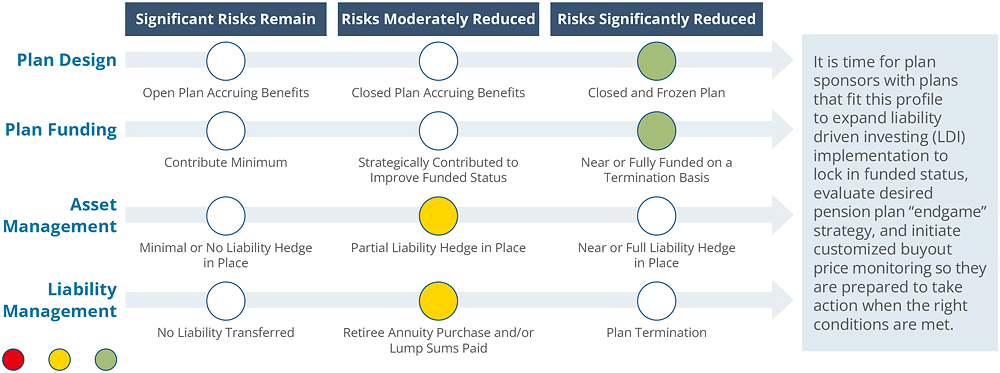

The stoplight schematic below illustrates the current pension risk profile for many DB plans in today’s environment.

Plan Sponsor “Should Do” List

Once a DB plan is hard frozen and close to or fully funded/overfunded, plan sponsors should take steps to expand LDI implementation and evaluate its desired pension plan “endgame” strategy, taking preparatory steps such as:

- Cleaning data (doing death & address checks, making sure all components of benefit calculations are readily available and certified, identifying qualified domestic relations order or death calculations that may need updating, paying de minimis lump sums, locating and commencing participants past minimum required distribution date or normal retirement date, etc.).

- Reviewing, cleaning plan document; adjusting complex disability or death provisions, to the extent allowable. Identifying plan termination provisions (e.g., what happens with a surplus?2). Ensuring all required amendments have been made.

- Strategizing for timing of plan termination, which may alter decisions regarding PBGC payments and/or minimum required contributions.

- Laying out a strategy for plan termination (or, if preferred, hibernation) – which may include lump sum windows, retiree liftouts, or other de-risking actions short of a full plan termination.

Taking some or all of these steps will simplify and streamline the process when it comes to terminating a DB plan. Plan termination can be a complex process where the scope, timing, and cost can be highly variable. Thorough preparation prior to initiation of the plan termination process can significantly reduce costs and add comfort/security regarding the end result.

Preparing the Asset Portfolio for Plan Termination

When a plan’s funding ratio range on an accounting basis is between 90% and 100% and the goal is termination, the plan’s investment objective should become complete liability hedging and an assessment of pension risk transfer (PRT) asset readiness be undertaken. This involves:

| Category | Description |

|---|---|

| 1. Maximizing precision of liability hedge | Phasing out any remaining return-seeking assets in favor of full liability hedge. The goal is to mitigate funded status volatility and align the timing of exiting the hedge with the annuity purchase. |

| 2. Managing to termination-basis liability profile | Adjusting expected cashflows to reflect realities of plan terminations (e.g., can no longer assume that participants will forfeit benefits by retiring late). |

| 3. Preparing for bifurcation of lump sum and annuity assets | Identifying expected lump sums to be paid, and when lump sum interest rates are set (thus lump sums are no longer sensitive to movements in interest rates). |

| 4. Considering potential for “Asset-in-Kind” annuity purchase | Understanding current practices for AIK transfer arrangements to optimally carry out the transaction. |

| 5. Disposing of illiquid assets (if any) | Working with an independent secondary market advisor to run a competitive auction-based sales process into a diverse institutional-only buyer universe. |

What Can Plan Sponsors Do with a Pension Surplus

Below is a summary on what plan sponsors can do with an overfunded DB plan at termination3.

- Use surplus to pay plan expenses.

- Assets can revert to plan sponsor, but:

- Plan document must allow for this (and language allowing it must be in place 5 years ahead of termination).

- 50% Excise tax applies, plus federal & state income tax (exceptions for plans maintained by tax exempt entities and governmental plans).

- Excise tax can be reduced to 20% if at least 25% of the surplus is transferred to a Qualified Replacement Plan (QRP), e.g., a 401k plan.

- Money that is transferred to the QRP is not subject to excise (or other) taxes.

- Qualified replacement plan must cover 95%+ of the active participants of the DB plan who remain as employees of the employer after the plan termination.

- 401k match is not allowed. A 401k or subsequent DB plan can be a QRP, but the 401k contribution cannot be a match.

- Sponsor has up to 7 years to allocate the assets transferred to the QRP.

- No rule about exactly how to distribute surplus amongst QRP plan participants, but should be non-discriminatory.

- Could use surplus to increase benefits pro rata for all participants in the existing DB plan.

- Increase the amount of pension benefits distributed via annuity purchase and/or lump sum payments.

- A benefit increase could involve a strategy to reduce an employer subsidy for retiree medical benefits – e.g., increase premiums charged to retirees, but with the benefit increase covering the medical plan increase.

- If the benefit increase does not use up all of the surplus, any reversion is taxed at 50% and not 20% unless the pro rata benefit increase uses up at least 20% of the surplus. But not more than 40% of the 20% may be used for inactive participant benefit increases.

A Fixed Income Strategy Update4

BofA Global Research recently revised their economic outlook and Fed trajectory and abandoned their U.S. recession call. The material shift in their U.S. macro and Fed outlook prompted a meaningful revision of U.S. rate forecasts. No recession means the higher rate environment we are currently in may be more resilient than initially anticipated. BCG’s view is that this will continue to underpin high DB plan funded statuses and place many DB plans in the “time for plan sponsor action” zone.

How BCG Can Help

BCG brings a unique level of service to its clients and a much-needed independent perspective. Our dedication and focus on pension risk consulting and PRT implementation provides an integrated, one-stop solution for employers looking to address and manage the risks involved in their pension programs. BCG helps clients with the full range of pension de-risking strategies from LDI approaches to partial or full PRT, with particular expertise navigating the complex and lengthy process of plan termination. BCG frequently works in collaboration with plan advisors, consulting actuaries, institutional investment consultants, asset managers and law firms and has established working relationships with all of the insurers that participate in the U.S. PRT industry.

Contact Us

Steve Keating, Managing Director

BCG Pension Risk Consultants | BCG Penbridge

T: 203-955-1566

E: skeating@bcgpension.com

LinkedIn

1 The FTSE Pension Liability Index represents a single discount rate that is representative of the accounting discount rate that may be used for a representative (sample) DB plan.

2 For fully funded or overfunded DB plans, there is very little upside to continue exposure to pension risk. If a surplus exists at plan termination, a 50% excise tax, plus federal and state income tax applies to any reversion unless steps are taken to reduce this tax burden as explained on next page.

3 There are additional uses of pension surplus outside of plan termination (e.g., merging an overfunded pension plan with an underfunded pension plan via an M&A transaction or a Code section 420 transfer to pay retiree medical or life insurance benefits).

4 BofA Global Research and BCG Pension Risk Consultants I BCG Penbridge (“BCG”) authored a collaborative article in July 2022, “Pension De-Risking – The Time for Plan Sponsor Action Is Now”. This section provides a brief update to the BofA viewpoints shared in the article and is being used with permission.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 4.95%

Term Vesteds (duration of 10) – 4.92%

Actives (duration of 15) – 4.84%

Annuity Purchase Rates as of September 1, 2023