The BCG Pension Insider

August 2021 – Volume 118, Edition 1

Is your Defined Benefit plan hard frozen? If so, chances are it has been hard frozen for some time. The question is: What are you waiting for?

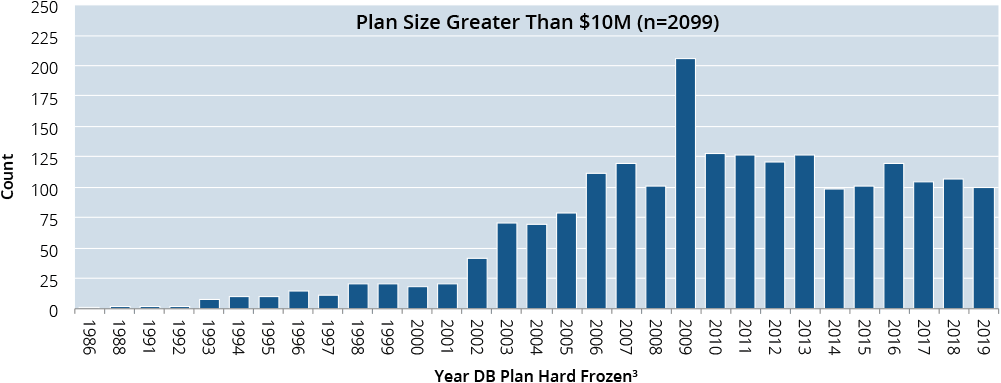

Roughly 40%1 of all ERISA qualified defined benefit (DB) plans over $10M in assets are hard frozen, meaning there are no further benefit accruals. Many of these plans have been hard frozen for some time. In fact, 81% of hard frozen DB plans have been frozen for five years or more, and 54% have been frozen for 10 years or more.

Hard Frozen DB Plans, by Year of Freeze2

Questions for Plan Sponsors of Hard Frozen DB Plans

With funding requirements and carrying costs (e.g., investment management, administration, actuarial, PBGC premiums, disbursement of retiree checks, etc.) for hard frozen DB plans being so significant, and with annuity pricing relative to plan accounting PBO values being so attractive (see BCG’s June 2021 paper on this topic), the first question is – “If you have no participants benefiting from the hard frozen DB plan in terms of future accruals, why maintain the plan on an ongoing basis?”.

Two common responses to this question are 1) the plan isn’t sufficiently funded to terminate, and 2) settlement accounting is a concern. For the first scenario, the response is straight-forward: either the plan sponsor has cash on hand or the ability to borrow funds, or they don’t have ready access to cash – in which case they would need to develop a strategy to increase plan funding over a period of time. Plan sponsors in this scenario should seek input from independent experts like BCG that could give them a current market perspective on DB plan termination costs. For many plan sponsors this is an eye-opening experience, that is, terminating their DB plan is not nearly as expensive as they may have come to believe (as noted above, see BCG’s June 2021 paper on this topic).

While BCG’s June 2021 paper shows DB plan termination annuity placement pricing is currently exceptional, the full picture is still not being captured. Termination of a DB plan requires the purchase of an annuity buyout contract covering all vested benefits of remaining plan participants and beneficiaries after lump sums are distributed. The important part here is “after lump sums are distributed.” For participants who have not yet retired, lump sums are meaningfully less expensive than an annuity buyout. The savings over an annuity buyout is typically at least 10%, though it can reach 30% or more in certain circumstances. Thus, lump sum “take rates” can be the most critical determinant of overall DB plan termination costs.

As a best practice for one-off retiree annuity buyouts vs. maintaining enough retirees for a plan’s ultimate termination, PRT insurers generally prefer at least a 1:1 ratio of retiree liability to deferred liability.

The second, but related, question is – “Given how long many DB plans have been hard frozen, is it safe to assume that the choice has been made to operate the plan indefinitely?”. In our experience, when we first engage with a plan sponsor of a hard frozen DB plan, the sponsor often doesn’t have a current understanding of what it takes to terminate a DB plan and move it off their books.

In light of this, plan sponsors may want to consider:

- “Do we have the right advisors/solution providers to objectively assess and help us clearly understand what outcomes or endgames we should consider for our hard frozen DB plan?”

- “Do we have a pension de-risking governance framework to ensure de-risking outcomes are achieved consistent with stated objectives?”

- “Once determined, do our current service providers have the necessary expertise and alignment of interests to achieve our go-forward plan objectives?”

How BCG Can Help

BCG Pension Risk Consultants | BCG Penbridge (“BCG”) specializes in assisting defined benefit plan sponsors with managing the costs and risks associated with their pension plans. Since 1983, BCG has successfully helped over 2,000 organizations achieve their pension de-risking goals. Our clients range from publicly-traded companies, to privately held firms, and include healthcare, banks and not-for-profit organizations. BCG helps clients with the full range of pension de-risking strategies from liability driven investing approaches to partial or full pension risk transfer, including navigating the complex and lengthy process of plan termination. BCG frequently works in collaboration with financial advisors, consulting actuaries, institutional investment consultants, asset managers and law firms. BCG is headquartered in Braintree, MA with satellite offices across the US.

- 1,2 Source: Pension Benefit Guaranty Corporation

- 32020 figures available in October 2021

- 4In general, settlement accounting for DB plans applies when the total benefit distributions for a given plan year exceed the sum of the service cost plus interest cost components of annual pension expense. For hard frozen plans, there’s no service costs so only interest cost would apply.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 1.70%

Term Vesteds (duration of 10) – 1.90%

Actives (duration of 15) – 2.04%

Annuity Purchase Rates as of August 1, 2021