The BCG Pension Insider

December 2021 – Volume 122, Edition 1

Expanding the Pension De-Risking Toolkit — Longevity Risk Transfer

Defined benefit pension plans have many risks, most of which are not core competencies, or the mainstream business of a plan sponsor. As a result, a large number of plan sponsors have mitigated or eliminated these risks over the past decade through the use of Liability Driven Investing (“LDI”), or by terminating their DB plan(s). The plan termination process can be long, and requires full funding and a willingness to accept sometimes significant earnings charges. Although quicker than the plan termination process, LDI removes only interest rate risk while addressing equity/market risk by allocating a smaller proportion of a plan’s overall assets to equities. Longevity risk is one of the largest remaining risks once a DB plan has moved to LDI, and it’s typically a risk a plan sponsor must bear until their plan is terminated, or a portion of the liability is settled through lump-sum payments or the purchase of an annuity contract.

Longevity Risk and Longevity Risk Transfer Defined

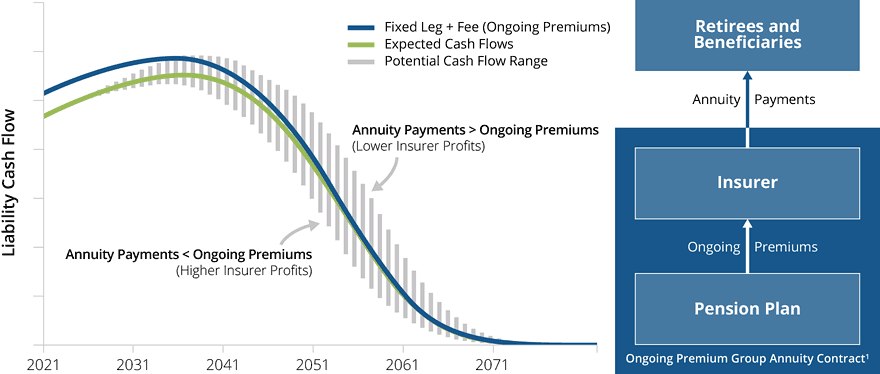

Plan sponsors, with help from their actuaries, have a certain expectation as to how long their participants will live, and thus can calculate the present value of the participants’ annuity payments. But future mortality improvements are very difficult to predict. If future mortality improvement is higher than the plan expects, participants may outlive these expectations, increasing pension costs for plan sponsors. The risk that mortality assumptions don’t match actual participant experience is known as Longevity Risk. There is a solution available in the market that can transfer this risk to an insurer called Longevity Risk Transfer (“LRT”). The schematic that follows depicts the mechanics of an LRT, along with a hypothetical cash flow diagram.

Longevity Risk Transfer Converts an Unknown Future Liability Into a Fixed Liability Cash Flow

Schematic and Flow Diagram Commentary

- Removes longevity risk on selected group of retirees and beneficiaries leaving the Insurer with the variability;

- Written as an ongoing premium group annuity contract1 as compared to a single premium group annuity contract;

- Fixes future payments (ongoing premiums) which provides the plan and its actuaries/investment managers with a fixed and defined set of liability cashflows for the selected group;

- Allows attention to be focused on asset management and moving towards desired funding position.

Summary of Cash Flows

| Ongoing Premiums (paid by Pension Plan to Insurer) | Ongoing premiums represent the expected monthly benefits payable plus a fee for risk and expenses that are defined and guaranteed at issue. The expense load is for the Insurer to administer the benefit payments. | Annuity Payments | Payable by the Insurer to the Pension Plan or directly to the Retirees and Beneficiaries. Represents the actual benefit payments due to Retirees and Beneficiaries from those lives included and covered at the inception of the group annuity contract. | Outcome of Ongoing Premiums = Certainty to Plan Sponsor | Since the actual annuity payments are paid by the Insurer, the ongoing premiums effectively transform the Pension Plan’s benefit cash flows to a known, fixed amount each period, making an LDI program even more airtight. |

|---|

Which Plans Might Enter an LRT?

Transferring longevity risk to an Insurer is similar to LDI and annuity buy-outs from a de-risking standpoint, as it removes future risk. By combining LDI with an LRT, the plan has essentially created a structure that is very similar to a retiree annuity buy-out without having to execute an annuity contract that covers both the asset risk and longevity risk. Sponsors who do not wish to incur the accounting (settlement) expense associated with a retiree annuity buyout might opt for an LRT as a way to reduce risk without the earnings impact. Sponsors who want the flexibility to invest their own assets in the future (even if locked into LDI today) might also consider an LRT as a way to take some risk off the table without dwindling the remaining assets of their plan. And plan sponsors that don’t have the funding level to terminate or buy out certain retirees might enter into an LRT as a low-cost step that gets them closer to completely de-risking the pension plan liability for the selected group. LRT is currently only available for large pension plans2, with thousands of retiree lives and ~$500m+ of retiree liabilities.

How Does it Work?

The plan sponsor identifies the retirees to include in the LRT and the Insurer determines the ongoing premiums for the LRT. There is no upfront premium. The plan sponsor would then pay the ongoing premiums on a monthly basis, while the Insurer would make the actual benefit payments (annuity payments) to the retirees and beneficiaries. Regardless of how the actual mortality plays out for the retirees, from the plan sponsor’s perspective, there is certainty to the benefits it must pay, and any risk associated with the actual longevity of the retirees has been removed. This certainty may also help to create a better customized fit for any LDI assets.

What are the Costs?

The Insurer would prefer to administer the benefits, and a cost for this administration would be included in the ongoing premiums3. Similarly, there is a price charged for the Insurer to take on the longevity risk, as well as to allow for a profit margin to the Insurer. These charges are all included in the ongoing premiums agreed to by the plan sponsor, in much the same way that risk transfer, administration, and profit are baked into the cost for a retiree annuity buy-out or buy-in. The big distinction from retiree annuity buy-outs and buy-ins is that with LRT, all costs are designed as an ongoing premium defined and guaranteed at issue and paid month-by-month, rather than being paid up front in a single premium.

How Can BCG Help

For plan sponsors interested in exploring LRT and that meet the specified size requirements, please contact us. We can share with you the data requirements for an ongoing premium LRT quotation and FAQs that address key issues such as fiduciary responsibility, contract form and transaction structure, including responsible party for administration. Note, the sooner BCG is involved the better, as we would work to ensure your retiree data and experience studies are in order, which is critical to ensuring a smooth quotation process.

- 1 The Ongoing Premium Group Annuity Contract is a new and proprietary pension de-risking solution BCG Pension Risk Consultants | BCG Penbridge (“BCG”) is developing in collaboration with a leading pension risk transfer insurance company.

- 2 Large plan size allows the Insurer to assess the mortality experience of a particular plan to determine the best price and not build in excess margin. Smaller plans are not out of the question, but assumption development becomes more challenging and the price could be higher.

- 3 The transfer of administration is preferred but not required by the Insurer. Typically, insurance companies will want to be in control of administration for the covered group, particularly with respect to existence checking, since the risk is now theirs instead of the plans.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 1.95%

Term Vesteds (duration of 10) – 2.08%

Actives (duration of 15) – 2.10%

Annuity Purchase Rates as of December 1, 2021