The BCG Pension Insider

June 2023 – Volume 140, Edition 1

Plan Sponsors Beware – Participating Group Annuity Contracts in DB Plans

The purchase of group annuity contracts to secure defined benefit pension benefits has been a growing pension risk transfer (“PRT”) trend over the past decade. Through a PRT, a plan transfers assets to an insurance company, the insurance company takes over payment of all future benefits and administration for a group of participants (most commonly retirees), and the plan sponsor no longer includes these assets or liabilities on its balance sheet or in any other reporting. The typical approach is a non-participating, single premium group annuity contract. But, beware if the plan holds an open or on-going participating group annuity contract, since this will complicate de-risking and plan termination. Many of these participating group annuity contracts were issued many years ago. The typical structure at that time was a group annuity contract that would fund pension plan benefits from time of hire through retirement. Many of these contracts have an insurance company guarantee for future benefit payments to participants covered by those contracts, and with some of the older contracts, the guarantee could apply to retirees and to participants in the deferral stage or not yet in pay status. Also with these contracts, future contributions to the insurer may be needed to cover the cost of the contractual guarantees, should investment and mortality experience not be as was expected at the time of issuing the contract.

For those DB plans that do have participating group annuity contracts, the plan sponsor may think of the contract as just another investment of the plan. But there may be limitations put in place by the participating contract that the plan sponsor may not understand. Notably, benefits for participants that are contractually guaranteed under the contract usually cannot be part of a lump sum offering or future annuity purchase. Further, if any participant not yet in pay status has a portion of their accrued benefit provided by a deferred annuity guaranteed under the contract, that portion cannot be paid out as part of a lump sum offering. They must remain with the existing insurer and paid in accordance with the terms of the participating annuity contract. This could make a plan unattractive to insurers when the plan sponsor wants to terminate, which could make placement of the PRT contract at termination difficult, or could substantially increase the cost of terminating a plan.

Another important consideration for participating contracts is whether the assets are valued at book value or market value as well as are there restrictions on withdrawals that could complicate the timing or add to the cost of a plan termination.

A Worked Example

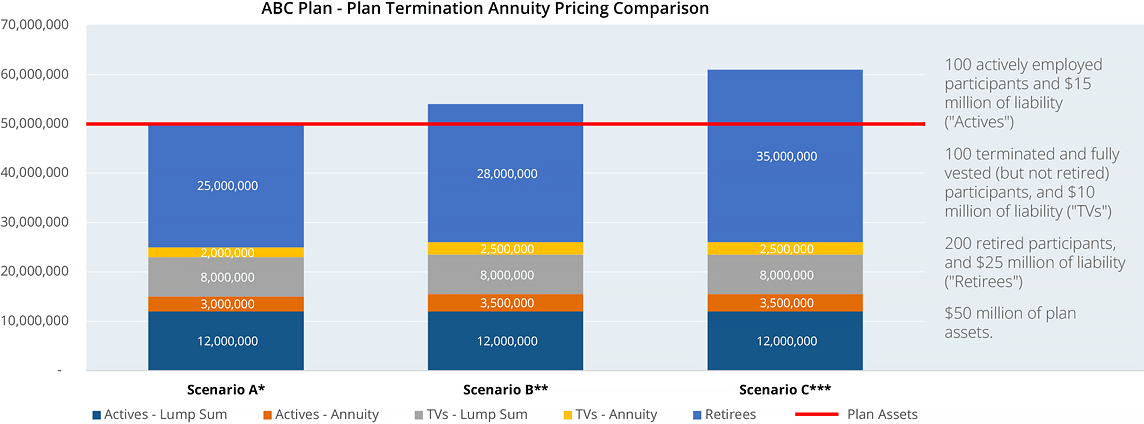

Worked Example: ABC Company Pension Plan (“ABC Plan”) has an ongoing participating group annuity contract with XYZ Insurance Company (“XYZ Insurer”), such that all participants are entered into this contract by the plan sponsor when they retire. The plan sponsor who wants to terminate may view ABC Plan along the lines of Scenario A below:

* Scenario A assumes a plan termination with an 80% lump sum take rate and full PRT insurer competition due to ABC Plan having a desired mix of retiree and deferred participants.

** Scenario B assumes a plan termination with same 80% lump sum take rate, but higher annuity costs for Actives and TVs due to ABC Plan having no retirees to include in the annuity bidding process. Under this scenario, ABC Plan's retirees are contractually required to be annuitized under the plan's ongoing participating annuity contract at XYZ Insurer's current annuity pricing rate.

*** Scenario C assumes a plan termination with same 80% lump sum take rate, but higher annuity costs for Actives and TVs due to ABC Plan having no retirees to include in the annuity bidding process. Under this scenario, ABC Plan's retirees are contractually required to be annuitized under the plan's ongoing participating annuity contract at XYZ Insurer's low annuity pricing rate of 2%.

Adding up the numbers in Scenario A, the plan sponsor may think ABC Plan is fully funded, with $50 million of assets and liabilities. But if they decide to terminate ABC Plan as represented in Scenario C above, they may find that the participating contract requires the annuity cost for the retirees to be calculated using contractually required purchase rates based on an artificially low interest rate (say 2%), in comparison to the rates currently used for valuing PRT (non-participating) annuity costs, which are currently closer to 5%. This contractual requirement could mean that ABC Plan must provide $35 million (rather than $25 million) to satisfy the retiree liabilities. That leaves only $15 million to pay for the $25 million of liabilities that remain for active and TV participants – and ABC Plan that appeared to be 100% funded is really only 60% funded!

To make matters worse, while most of the 200 active and TV participants will likely opt to take a lump sum during a plan termination, there may be ~50 participants that don’t want the lump sum (based on an assumed lump sum take rate of 75%), and need to have an annuity purchased for them. Ordinarily, these 50 participants would be combined with the 200 retirees, making for an attractive annuity purchase for which many insurers would want to participate. Instead, there are zero retirees that can be included in the annuity purchase, as all 200 retirees are “locked-in” with XYZ Insurer. Purchasing annuities for the remaining 50 participants will now be difficult (and more costly) as few, if any, insurance companies would likely be willing to participate in a group annuity purchase that contains zero retired participants. In the worked example, we show higher annuity costs of $500,000 for Actives and TVs (an illustrative estimate) due to ABC Plan having no retirees to include in the annuity bidding process.

An Alternative Example

Alternative Example (Scenario B): As an alternative to the contractual provisions of Scenario C, XYZ Insurer might be willing to consider an alternative to the contractually required annuity purchase and provide an annuity price based on its current PRT annuity pricing rates. If available, this is clearly a much better situation for the plan sponsor, as it will not have to pay the full $35 million to satisfy $25 million of retiree liabilities. But XYZ Insurer has no competitive pressure to provide a great price for these retirees. XYZ Insurer’s current PRT annuity pricing may be a quote of $28 million, more than 10% above what a competitive auction of these retirees might yield. This is a better result than Scenario C, but still costly when compared to what the cost might be if the plan sponsor had never entered into the participating annuity contract. And the difficulty placing the annuities for the remaining ~50 non-retired participants still remains, since the retirees are still with XYZ insurer.

So Why Did Plan Sponsors Enter Into Such Contracts

Oftentimes, these are very old contracts entered into decades ago. In that time period, pension plan sponsors were looking for a one-stop shop that would fund its pension plan, provide administration and valuation purposes, provide a guarantee to retirees (and certain deferred benefits), and continue to give them the opportunity to participate in the experience of the plan. These contracts, often called deposit administration contracts, or immediate participation guarantee contracts, were very popular during the 1980’s and there were many more insurance companies who had the infrastructure and resources to provide this full- service product. In addition, these contracts could also exempt the plan sponsor from paying PBGC premiums for retirees in pay status, since XYZ Insurer has guaranteed the benefit in the form of an “irrevocable commitment” (thus the PBGC need not guarantee the benefits). Safe to say that when these contracts are (or were) entered into, the plan sponsor was not contemplating plan termination.

What Can Be Done

Understanding early on the implications of discontinuing or terminating a participating contract on the ultimate cost of plan termination and annuity pricing is certainly crucial. From the worked example above, the plan sponsor should understand that ABC Plan is not 100% funded, and adjust its investment and contribution policies accordingly. If the plan is terminating, securing information on the participants and benefits guaranteed under the contract is an important first step to understanding whether or not the carrier has been diligent in conducting death audits to ensure the carrier is not over-reserving for the guarantees. This effort to understand what benefits have already been secured demonstrates best practice from a fiduciary perspective in ensuring all plan benefits are properly accounted for in the plan termination. It is also important to explore discontinuance options and strategies and whether the carrier is willing to convert the contract to a non-participating basis given the plan’s termination. Understanding the implications of discontinuing or terminating the contract from an asset value perspective is also very important to assess the impact of these contracts on a plan termination. Also, if participants are still being added to the contract as they retire, it may be helpful for the plan sponsor to stop this practice. While participants who are already covered under the contract cannot be unwound, the plan sponsor can prevent future retirees from being added to the contract. It is also possible that PBGC premiums have erroneously been paid for participants covered under such a contract. If that is the case, PBGC premiums may be amended (for up to 7 years), and a refund of prior premium payments given to ABC Plan by the PBGC. Legal as well as actuarial support may be needed to see if ABC Plan qualifies for a refund of PBGC premiums.

How Can BCG Help

Participating group annuity contracts like those described above are not always easy to identify and may be confused with simple annuity investments. BCG can help a plan sponsor to identify such annuities, understand its contractual options, and guide the plan sponsor regarding what questions to ask an insurer (and steps to take) related to the contract. BCG can also assist with developing appropriate pension de-risking strategies for those participants in a plan who are not covered by these participating contracts.

Contact Us

Steve Keating, Managing Director

BCG Pension Risk Consultants | BCG Penbridge

T: 203-955-1566

E: skeating@bcgpension.com

LinkedIn

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 4.63%

Term Vesteds (duration of 10) – 4.62%

Actives (duration of 15) – 4.55%

Annuity Purchase Rates as of June 1, 2023