The BCG Pension Insider

March 2021 – Volume 113, Edition 1

Pension De-Risking – A Recommended First Step

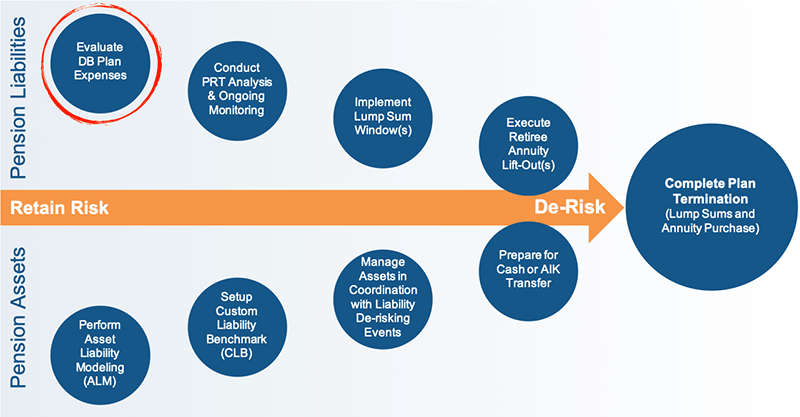

The pension de-risking roadmap depicted below is intended to help defined benefit plan sponsors answer the question, “How do I get started down my plan’s de-risking path?”. This roadmap captures steps that can be taken from a pension liability perspective and from a pension asset perspective.

Pension De-Risking Roadmap

At BCG Pension Risk Consultants I BCG Penbridge (BCG), we often recommend that the first action any plan sponsor should take is to evaluate their DB plan’s expenses, i.e., “What are my plan’s holding costs?”.

Plan sponsors are very aware of the high cost of PBGC premiums. These costs can be up to $668 per participant per year. But, on top of this, fees to manage a plan’s assets can run up to 1% (100 basis points) or more, depending on the investment strategy and whether or not the plan uses an investment advisor. And, if a plan does use an advisor, fees are dependent on whether it’s in an ERISA 3(21) fiduciary advisor basis, or in an ERISA 3(38) Investment Manager capacity. There are also plan administration per-participant costs for mailing pension checks, 1099s, annual notices and statements, etc. Then, there are costs for other plan services such as trust and custody and actuarial, as well as legal and plan auditing. Some plan sponsors can manage their plans efficiently and can keep their plans’ annual expense ratio between 0.50% and 1.50%, while others may be realizing much higher annual costs (e.g., those plans with significant allocation to higher return-seeking investment strategies). The bottom line is that DB plan expenses are very plan dependent, and plan sponsors -- especially those considering de-risking their plan -- should begin assembling their de-risking roadmap by getting a handle on their plans’ expenses in order to make informed decisions to reduce cost and risk.

How Can BCG Help?

BCG conducts the only industrywide survey to capture all the costs associated with maintaining a U.S. defined benefit pension plan. The survey process helps sponsors to identify the full range of plan expenses and to improve plan governance and efficiency. Participating in the survey is a great way for plan sponsors to look for better cost efficiency in the operation of their plans and to find out which costs can be removed via pension risk transfers.

In exchange for plan sponsor participation, BCG provides, at no charge, a customized DB Expense Benchmarks Report. A Benchmarks Report includes analysis which illustrates:

- a defined benefit plan’s total expense ratio in comparison to other participating plans by plan size

- a plan’s expenses by category in comparison to the average expenses for other plans; and

- a percentile analysis showing how each category of the plan expenses ranks relative to other plans

To view a sample BCG DB Expense Benchmarks Report, click here

To register to participate in the BCG Defined Benefit Expense Survey*, click here

* If you decide to participate in the survey, you can expect it to take approximately 1 hour to collect your plan expense information and 20-30 minutes to complete the survey. Upon registration, you will receive a link to complete the survey online, and a PDF copy of the survey that describes the information needed to complete the survey. Report production typically takes 1-2 weeks after receipt of the fully completed survey.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 1.89%

Term Vesteds (duration of 10) – 2.15%

Actives (duration of 15) – 2.26%

Annuity Purchase Rates as of March 1, 2021