The BCG Pension Insider

May 2022 – Volume 127, Edition 1

Factors Determining Whether an Insurer Will Decide to Bid on a PRT Annuity Placement

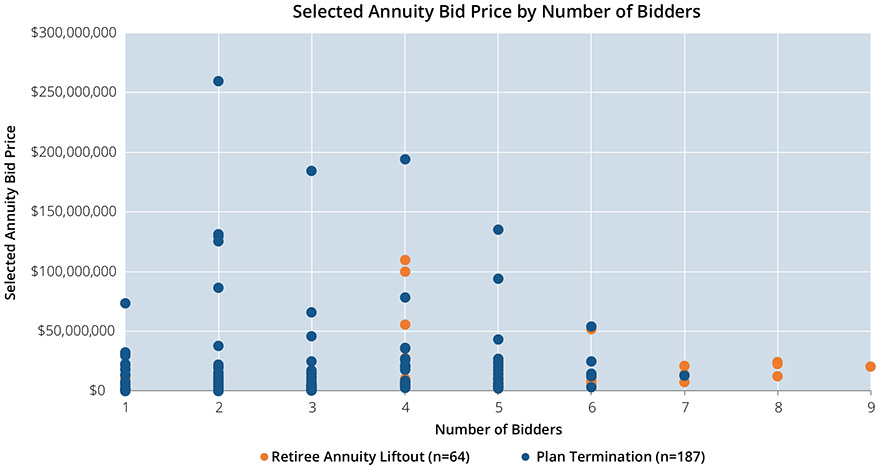

Why is it that some defined benefit annuity placements will have only one or two pension risk transfer (PRT) insurers bidding on a particular opportunity, while others may have half a dozen or more? One critical factor is the size of the annuity purchase. But as the chart below shows, there is much more beyond just the size of the purchase that will determine number of bidders.

BCG Annuity Placement Transactions 2017-2021 (n=251)*

* BCG’s 251 PRT annuity transactions equate to a 11% market share in the U.S. for the five-year period ending December 31, 2021. Total number of U.S. PRT annuity transactions was 2,277 over this same time period.

PRT Insurer Underwriting Considerations

While liability size certainly is critical in determining which insurance companies will decide to bid on a PRT annuity placement, the characteristics of the liability are also important. Out of the 19 insurers in the PRT market in 2021, some insurers participated solely on larger opportunities that were retiree only, while others routinely participated in larger opportunities, whether it was a plan termination (deferred+retiree) opportunity or a retiree-only opportunity. Other insurers focused more on medium- and smaller-sized opportunities across both plan termination and retiree-only placements. For BCG’s retiree annuity liftouts, the average number of insurers participating was 4.3, versus an average of 2.8 for plan terminations for the five-year period ending December 31, 2021. The number of participating insurers typically declines if non-retired lives are included, which is typical for plan terminations.

Timing and insurer capacity will also affect participation from insurers in an annuity placement. Each insurer will have a finite amount of capacity to accurately price and transition any annuity placement opportunity. The fourth quarter of each of the past few years has been especially busy, causing some insurers to cite capacity restraints. Thus, planning ahead to avoid these busy times of year (or at least to get on insurers’ calendars early) can help to garner more interest in a transaction.

Finally, plan provisions will cause insurers to decline to participate, and will also cause pricing to vary for those that do participate. While most retiree-only liftouts tend to be fairly “vanilla”, there are certain features such as cost-of-living adjustments, post-retirement death benefits (i.e., lump sum death benefit or life insurance), dependent-child benefits, or even the fairly common Social Security Levelling annuity options that might cause one or more insurers to drop out of contention. For plans with non-retired lives, there are many plan provisions or administrative considerations that can prove problematic for insurers. Also problematic for insurers are cash balance liabilities or those where the transaction covers only non-retired lives (which is not very common).

Finally, there are a multitude of factors beyond size and the presence of non-retired lives that will determine which, and how many, insurers will decide to bid on a PRT annuity placement. The list below highlights just a few important considerations to contemplate when planning for an annuity transaction. BCG experts are happy to discuss the specifics of any defined benefit plan and strategize how best to leverage opportunities in the pension group annuity marketplace to achieve an outstanding outcome. Factors that will determine insurer participation include:

- Ratio of non-retired liability to retiree liability

- Size of placement (<$5m, <$25m, <$50m, <$100m, <$250m, <$500m, etc.)

- Headcount (e.g. smaller benefits / blue collar mortality vs. larger benefits / white collar mortality)

- State/jurisdiction of plan sponsor (not all insurers are licensed in New York or Puerto Rico)

- Time of year (and capacity constraints from insurers, particularly notable in the fourth quarter)

- Complexity of plan provisions (grandfathered/legacy benefits, benefit offsets, etc.)

- Incomplete data (e.g., missing dates of birth for participants and beneficiaries, missing or incorrect gender, lack of information about past employment status, no zip code+4)

- Bad data and/or missing participants (perhaps indicated by large portion of non-retired lives past normal retirement date or required minimum distribution date)

- Insurer familiarity/history with annuity placement specialist

How Can BCG Help

BCG helps plan sponsors identify, objectively evaluate and implement strategies to efficiently reduce defined benefit plan cost and risk. We have deep experience in helping clients with the full range of pension de-risking strategies from liability driven investing approaches to partial or full pension risk transfer, including navigating the complex and lengthy process of plan termination. BCG is one of the most active annuity placement specialists in the United States, averaging about one placement per week. Our annuity placement process is designed to drive the lowest price in the annuity market.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 3.70%

Term Vesteds (duration of 10) – 3.74%

Actives (duration of 15) – 3.69%

Annuity Purchase Rates as of May 1, 2022