The BCG Pension Insider

June 2022 – Volume 128, Edition 1

Tips for a CFO’s Better Night’s Sleep

In the years after the financial crisis of 2008, defined benefit pension plan risks have become a top priority for U.S. corporate pension plan sponsors. Following the financial crisis, plan sponsors diligently worked to reduce balance sheet exposure to pension liabilities through a variety of pension de-risking strategies, including plan redesign (e.g., plan closures or freezes), in-plan strategies such as liability driven investing, and pension risk transfer (“PRT”) strategies such as lump sum offerings and annuity buyouts.

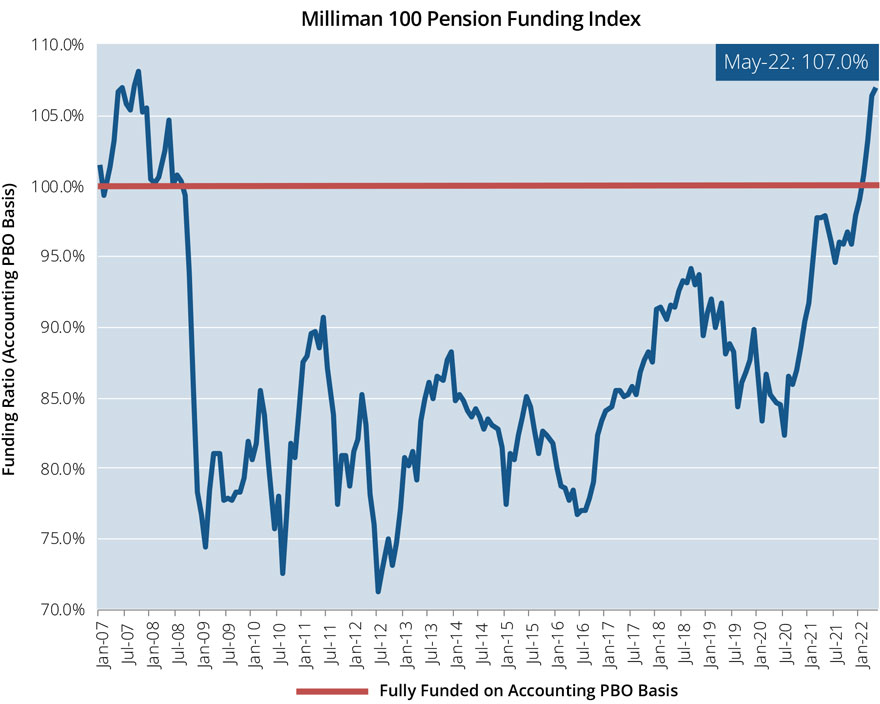

Average DB Plan Funding Ratio at a 15-Year High*

The Milliman 100 Pension Funding Index covers the 100 largest defined benefit pension plans sponsored by U.S. public companies.

* Source: Milliman.

Fast forward to the current period, as the chart above shows, pension plan funded status as represented by the Milliman 100 Pension Funding Index was back up to 107.0% on an accounting PBO basis at the end of May. This was its highest point since before the financial crisis, driven by solid equity returns in 2020 and 2021, followed by a spike in interest rates in 2022. This average funding level means that many pension plan sponsors are fully funded or overfunded on a plan termination basis and that lump sums can be paid and annuities purchased for all of their plan’s participant’s without needing to contribute much (if any) capital beyond distributing the assets that are already in the plan. Continuing exposure to pension risk for these well-funded plans may have very little upside, as pension surplus may be heavily taxed if/when plan termination occurs.

At the same time, extreme volatility is now gripping the stock and bond markets due to a host of factors, so taking steps to preserve plan funded status is also crucial. It is in critical “all hands on deck” times like these that CFO’s and pension plan leaders with well-funded DB plans ask BCG Pension Risk Consultants I BCG Penbridge (“BCG”), what they should be thinking about and doing right now.

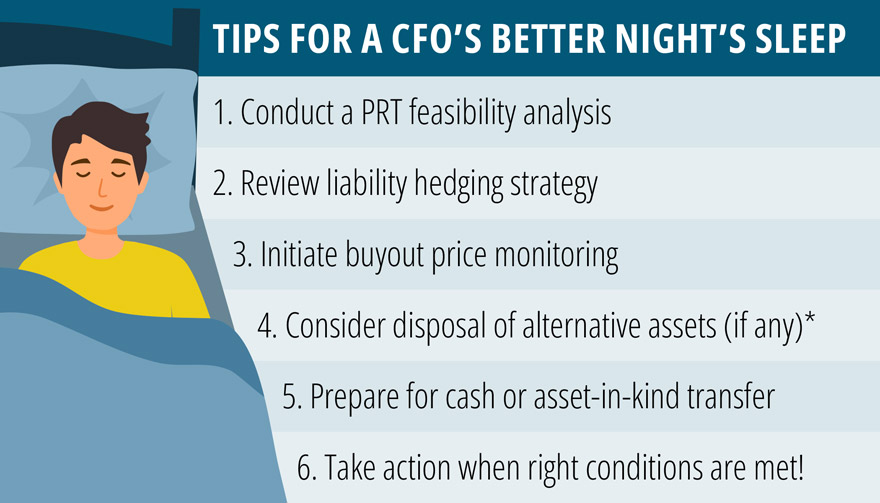

Tips For A CFO’s Better Night’s Sleep

Here’s our advice of what CFO’s and pension plan leaders with well-funded DB plans can do to get a better night’s sleep.

* Alternative assets can delay a plan termination, to the extent they are not easily liquidated.

The plan sponsor needs independent and unbiased advice. Because BCG provides no ongoing plan services, we can serve as a pure advocate for plan sponsor best interests and complement the work being performed by existing advisors. 100% of BCG firm revenue comes from pension risk consulting, comprehensive implementation support and related services.

For the 10-year period ending December 31, 2021, BCG completed 461 PRT annuity transactions which equates to a 12% market share in the U.S. PRT market by number of transactions (i.e., 1 out of every 8 annuity placement deals).

How Can BCG Help

BCG Pension Risk Consultants | BCG Penbridge (“BCG”) specializes in assisting defined benefit plan sponsors with managing the costs and risks associated with their pension plans. Since 1983, BCG has successfully helped over 2,500 organizations achieve their pension de-risking goals. Our clients range from publicly-traded companies, to privately held firms, and include manufacturing, healthcare, banks and not-for-profit organizations. BCG helps clients with the full range of pension de-risking strategies from liability driven investing approaches to partial or full pension risk transfer, including navigating the complex and lengthy process of plan termination. BCG frequently works in collaboration with financial advisors, consulting actuaries, institutional investment consultants, asset managers and law firms. BCG is headquartered in Braintree, MA with satellite offices across the US. Please visit our website at: www.bcgpension.com.

Midland National Commences Participation in BCG’s Monthly Annuity Buyout Pricing Survey

Midland National Life Insurance Company (Midland National) is now participating in BCG’s monthly annuity buyout pricing survey, effective this month. Midland National entered the US Pension Risk Transfer (PRT) market in 2020 and has written nearly $200 million of PRT annuities across 40+ transactions as of March 31, 2022.

Midland National credits the company’s competitive strength in the PRT market to its commitment to stability, innovation, and dedicated and responsive customer service. Midland National has earned an A+ (Superior) rating from A.M. Best, a large third-party independent reporting and rating company that rates an insurance company on the basis of the company's financial strength, operating performance, and ability to meet its ongoing obligations to policyowners. Midland National is a member company of privately owned Sammons® Financial Group, Inc. Its companies include Midland National® Life Insurance Company (including Sammons® Corporate Markets); North American Company for Life and Health Insurance®; Sammons Institutional Group® (including Midland Retirement Distributors® and Sammons Retirement Solutions®) and Beacon Capital Management, Inc.

In total, there are 18 PRT insurers currently active in the market, with ten new entrants since 2014 that remain in the market. Of the 18 insurers, 14 are now participating in BCG’s monthly pricing survey. Other participating insurers include AIG, Athene, Fidelity & Guaranty, Legal & General, MassMutual, MetLife, Mutual of Omaha, OneAmerica, Pacific Life, Principal, Prudential, Securian Financial and Western & Southern.

BCG uses the rates gathered in its survey to measure and monitor annuity pricing for its clients via its PRT Analysis and Customized Buyout Price Monitoring (CBPM) services and also to compile the BCG PRT Index, which is the longest standing pension buyout index in the United States. The Index provides an easy comparison of annuity pricing to various important pension liability measures.

To learn more about BCG’s PRT Analysis and CBPM services or the BCG PRT Index, please visit www.bcgpension.com

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 3.76%

Term Vesteds (duration of 10) – 3.81%

Actives (duration of 15) – 3.76%

Annuity Purchase Rates as of June 1, 2022