The BCG Pension Insider

April 2021 – Volume 114, Edition 1

Liability Driven Investing When Plan Termination is the “Endgame” Objective

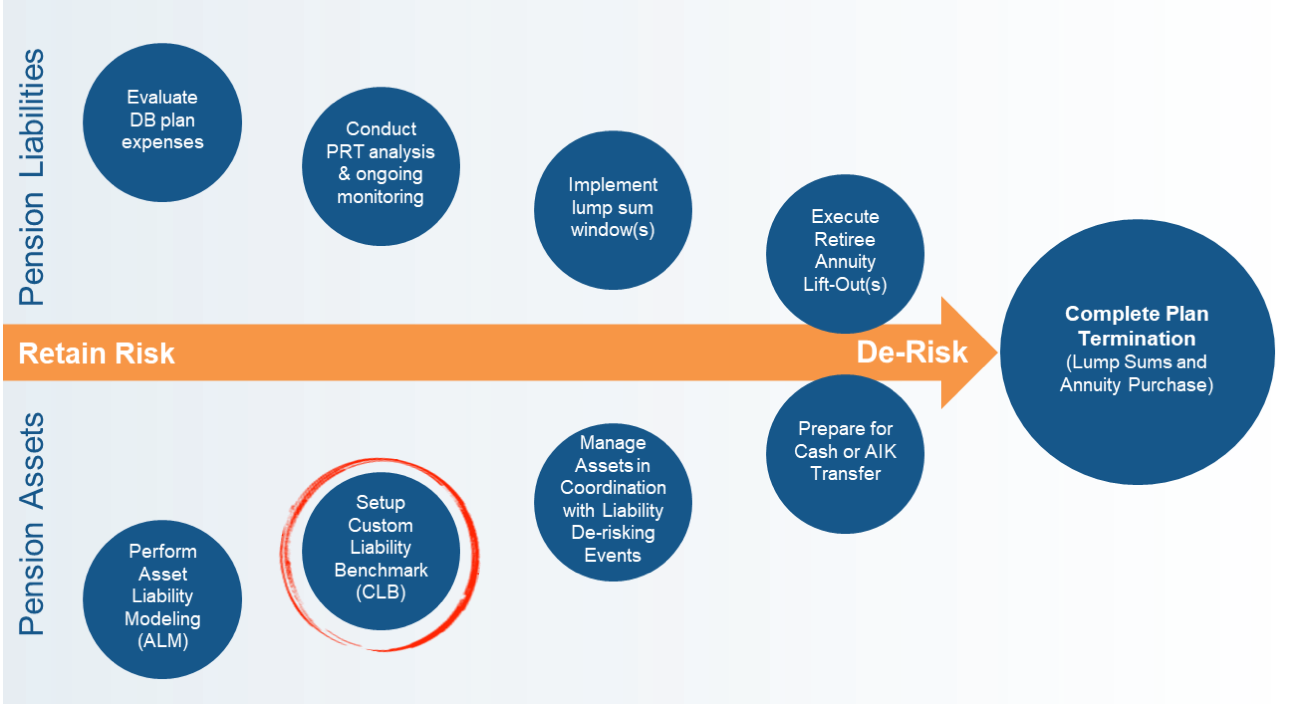

As a defined benefit (DB) plan sponsor, it is imperative you work with advisors who are aligned with your objectives and understand your goals and time horizon. In last month’s newsletter we discussed that evaluating DB plan expenses was BCG’s recommended first step for any plan’s pension de-risking journey. This month, we will focus on the asset side of the pension plan balance sheet -- more specifically, the important role liability driven investing (LDI) plays when plan termination is the endgame objective.

Pension De-Risking Road Map – A Customized Approach

For DB plans moving toward termination, whether a plan is two years away, five years away or ten years away; a key element for the plan sponsor and their advisor is to employ a custom liability benchmark (CLB), aka “Custom LDI*,” based on a plan’s liability. A CLB is designed using the plan’s specific liability cash flows to replicate the interest sensitivity of the plan to mitigate funded status volatility. A CLB provides a customized hedge to a plan’s liabilities. Managing the following risks are important objectives of constructing a CLB:

- Duration risk*,

- Yield curve risk*, and

- Corporate bond spread risk*

* See definitions at the bottom of this article for further explanation.

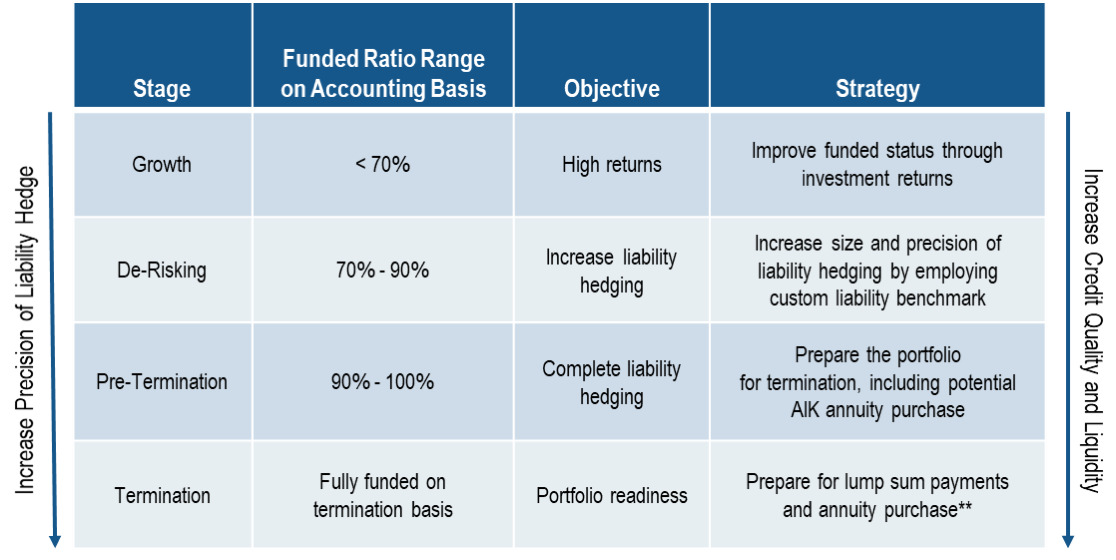

Any de-risking approach that does not consider all three risks introduces unnecessary volatility to a plan’s funded status. The schematic below shows the four plan investment stages to termination which require close coordination between the LDI manager and the pension risk transfer (PRT) consultant.

Four Investment Stages to Plan Termination

** Cash for lump sum payments; cash or AIK transfer for annuity purchase

The above schematic shows how a plan’s funded ratio on an accounting basis could serve to establish a plan’s objectives and strategy and emphasizes the importance of implementing a flexible CLB as a plan moves toward termination. For example, in a plan’s growth stage, a plan’s underfunded status warrants large allocations to return-seeking strategies; but as a result, surplus volatility is often ignored. However, it is at this stage that a plan sponsor should begin setting the framework for a plan’s LDI fixed income allocation.

A CLB provides a more precise liability hedge to interest rates during the de-risking, pre-termination and termination stages. Additionally, a CLB is also suitable for a potential future asset-in-kind (AIK) transfer when it comes time to purchase an annuity contract from an insurance company***. Because a CLB is largely comprised of individual credit securities that match a plan’s specific liabilities, the asset transfer can be more easily integrated into the insurance company’s investment portfolio, providing potential savings for the annuity purchase.

*** According to BCG’s 2021 Survey of Asset-In Kind Practices of PRT Providers, AIK transfers can often deliver savings between 0.50% and 1.50%. The survey did indicate that most providers prefer a minimum of $50 million in order to quote on an AIK basis, but some insurers highlighted flexibility on this minimum. BCG’s recent experience confirms this flexibility, as PRT Providers quoted on an AIK basis for case sizes under $15 million during 2020.

How Can BCG Help

In January 2021, BCG announced a collaboration with a leading LDI manager to provide plan sponsors and advisors the first-of-its-kind collaborative advisor offering for DB plan LDI and PRT services focused on delivering endgame solutions. The collaborative solution is designed to break down the inefficiencies in information sharing and decision making that arise when PRT consultants and asset managers are not closely aligned, bringing together asset management and liability management through a highly coordinated and unified set of services. For plan sponsors and advisors navigating their de-risking journey, a customized LDI-PRT approach provides the most comprehensive solution.

Definitions

Custom LDI = Mix of treasury bonds and individual credit securities that match a plan’s liability and forms the basis for investing the portfolio and performance measurement; suitable for future asset-in-kind transfer to insurers.

Duration risk = the risk associated with changes in the absolute level of interest rates (parallel shifts).

Yield curve risk = the risk associated with changes in the term structure of interest rates or shape of the yield curve (non-parallel shifts).

Corporate bond spread risk = the risk associated with changes in corporate bond spreads (relative to Treasury rates) compared to the high-quality pension discount rate.

To inquire about BCG’s collaborative advisor offering for LDI and PRT services, please contact Steve Keating at 203-955-1566 or skeating@bcgpension.com.

To request a DB plan consultation with BCG, please click here. Thank you.

Legal & General Retirement America Commences Participation in BCG’s Monthly Annuity Buyout Pricing Survey

Legal & General Retirement America (LGRA) is now participating in BCG’s monthly annuity buyout pricing survey, effective this month. LGRA entered the US Pension Risk Transfer (PRT) market in 2015 and has written over $5 billion of PRT annuities across 72 transactions as of 12/31/2020.

LGRA is a business unit of Legal & General America, part of the worldwide Legal & General Group Plc. Established in 1836, Legal & General Group Plc. is one of the world’s leading financial services companies and a global leader in PRT. The company is uniquely positioned to write global PRT business and completed its first two global transactions across the US and UK in 2020.

In total, there are 18 PRT insurers currently active in the market, with ten new entrants since 2014. Of the 18 insurers, 11 are now participating in BCG’s monthly pricing survey. Other participating insurers include AIG, MassMutual, MetLife, Mutual of Omaha, OneAmerica, Pacific Life, Principal, Prudential, Securian Financial and Western & Southern.

BCG uses the rates gathered in its survey to monitor annuity pricing for its clients via its customized buyout price monitoring (CBPM) service and also to compile the BCG PRT Index, which is the longest standing pension buyout index in the United States. The Index provides an easy comparison of annuity pricing to various important pension liability measures.

To learn more about BCG’s CBPM service or the BCG PRT Index, please visit www.bcgpension.com

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 2.13%

Term Vesteds (duration of 10) – 2.38%

Actives (duration of 15) – 2.47%

Annuity Purchase Rates as of April 1, 2021