The BCG Pension Insider

October 2023 – Volume 144, Edition 1

Two Foundational Questions that Demand C-Suite/Board Attention

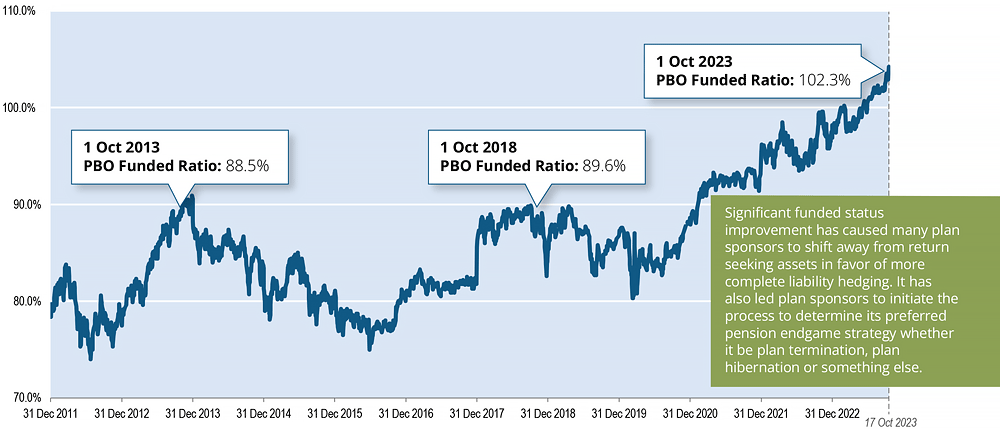

Due to rising interest rates, the average defined benefit pension plan is currently at its highest funded ratio since before the global financial crisis and as a result plan sponsors are being faced with critical strategic decisions regarding the future direction of their plan(s).

DB Plan PBO Funded Ratio for S&P 500 Companies since December 31, 20111

Source: Aon Pension Risk Tracker

Two Foundational Governance/Strategy Questions

For plan sponsors with fully funded or overfunded DB plans on a plan termination basis, strategic pension endgame decisions and advice are extremely important and highly specific to the circumstances of each plan sponsor. Depending on which endgame strategy is ultimately chosen, there can be real implications for all of the current plan stakeholders involved (e.g., phasing out return-seeking assets in favor of more LDI fixed income can lead to an immediate reduction in corporate earnings and more or less emphasis on certain internal/external processes). Before diving into all the governance and strategy issues and questions that will need to be addressed, two foundational governance/strategy questions that demand C-Suite/Board attention are as follows:

- “How can we ensure that we understand and deliver answers to the pension endgame question with impartial in-house resources?”; and

- “Which trusted, impartial advisors should be engaged to assist with this question?”

Additional Governance/Strategy Questions

Shedding legacy pension risk is increasingly becoming a necessary objective for many corporations. For many plan sponsors, this will or has already put defined benefit plan governance at a critical stage. Too many inherent conflicts of interest may exist for internal pension management staff and incumbent plan advisors/service providers to objectively assess and decide the course of action and ultimate endgame for a DB plan. For plan sponsors that have DB plans in a fully funded or overfunded position on a plan termination basis, additional governance/strategy questions may include: [rationale explained below each question]

- What are the go-forward objectives of the DB plan? Do you have a strategic de-risking plan in place?

De-risking the pension reduces leverage and firm beta. Pension de-risking announcements have been well received by shareholders, credit rating agencies and other stakeholders. A separate question to ask may be, have you considered enhancing other benefit plans while de-risking the DB plan? This may include things like offering guaranteed retirement income via the defined contribution plan. - Has the company’s senior financial management/board been educated on the range of pension de-risking strategies available, the trade-offs and the financial implications?

Similar to a potential M&A transaction, as a matter of corporate governance, the senior financial management/board should know what de-risking strategies are available that could have a major impact on the company’s financials and risk profile, including the costs and trade-offs of adopting a strategy and how it compares to other capital allocation strategies. - Do you know how your plan’s funded status on an accounting basis (GAAP or IAS) compares to your plan’s funded status on a plan termination basis?

The plan sponsor cannot assess whether or not PRT is right for their company without a credible estimate of its financial impact. Any immediate settlement losses need to be weighed against improvement of future earnings and reduction of balance sheet volatility. Additionally, for plans that are overfunded, there can be compelling enterprise-wide benefits to maintaining an overfunded plan (or perhaps pursuing a strategy to marginally increase the surplus) instead of pursuing a PRT transaction.2 - Have you assessed the ongoing and future expense structure attributed to your DB plan?

PRT can reduce many plan-related costs, including administration, actuarial valuation/reporting, investment management, PBGC premiums, external consulting costs and can also reduce the time internal management needs to spend on the plan. Many plan sponsors are surprised by the magnitude of the present value of these costs, which are not included in the present value of liabilities. Evaluating DB plan costs can also support a plan hibernation strategy where one of the objectives is often to maintain low expenses. - Have you put in place an annuity buy-out price monitoring program customized to your plan to identify opportunistic times to execute a PRT transaction?

Annuity pricing is often below the annuitized group’s PBO accounting value. Ideally, plan sponsors want to be able to monitor annuity pricing for their plan and be prepared to take action when the right conditions are met for their plan and situation.

Potential conflict of interest issues surrounding the future direction of DB plans needs to be thought through carefully and addressed in a manner that allows for informed and unbiased decision making. For plan sponsors and their C-Suite/Boards, answering the two foundational questions and additional governance/strategy questions is a great start.

How BCG Can Help

BCG brings a unique level of service to its clients and a much-needed independent perspective. Our dedication and focus on pension risk consulting and PRT implementation provides an integrated, one-stop solution for employers looking to address and manage the risks involved in their pension programs. BCG helps clients with the full range of pension de-risking strategies from LDI approaches to partial or full PRT, with particular expertise navigating the complex and lengthy process of plan termination. BCG frequently works in collaboration with plan advisors, consulting actuaries, institutional investment consultants, asset managers and law firms and has established working relationships with all of the insurers that participate in the U.S. PRT industry.

Contact Us

Steve Keating, Managing Director

BCG Pension Risk Consultants | BCG Penbridge

T: 203-955-1566

E: skeating@bcgpension.com

LinkedIn

1 PBO Funded Ratio captures to what extent a plan’s assets are sufficient to meet a plan’s liabilities as measured on the accounting basis under US GAAP, expressed as a percentage (e.g., “fully funded” means at least 100%). The accounting PBO liability measurement reflects current, high quality (AA) corporate bond rates, as well as service accrued to date and salary improvements projected through retirement (salary projections don’t apply for frozen plans, or plans that are not salary-related).

2 Unless a plan sponsor is certain their DB plan will not be terminated in the foreseeable future, it is important to note that adding an allocation or increasing the allocation to alternative assets as part of any surplus optimization portfolio is not advisable due to PRT insurers having limited or no appetite for alternative assets as part of any asset-in-kind transfer associated with annuity buyouts, as well as the difficulty in being able to transfer alternative assets to insurers even if they are interested.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 5.31%

Term Vesteds (duration of 10) – 5.27%

Actives (duration of 15) – 5.20%

Annuity Purchase Rates as of October 1, 2023