The BCG Pension Insider

January 2023 – Volume 135, Edition 1

BCG Thought Leadership 2022 Roundup, A Look Ahead to How the Pension De-Risking Market is Evolving in 2023 and Beyond and A Big Thank You

BCG thought leadership addresses topics relevant to the U.S. pension de-risking market, leveraging BCG’s leadership position to share its insights and perspectives, as well as those of other pension industry experts.

Happy New Year! In this special edition newsletter (our regular monthly newsletter will be distributed next week), we are taking a look back at the articles, surveys, spotlight Q&A interviews, etc. that BCG authored and published in 2022. We also offer a look ahead to how we see the pension de-risking market evolving in 2023 and beyond as well as a big thank you.

COVID-19 Pandemic and Future Pension Risk Transfer Mortality – What’s Next? | 12.2022

It goes without saying that the COVID-19 pandemic has significantly affected the world in all aspects of daily living. The impact on the insurance industry, and in particular pension risk transfer (“PRT”), goes beyond just the number of deaths that have occurred. This article focuses on the mortality impacts, both historically as well as what the future may bring, with a focus on potential impacts on insurers’ PRT business. It also addresses the additional information that PRT insurers are using and requesting in evaluating PRT transaction opportunities.

Q&A with Corebridge Financial: The Growing Use of Buy-ins to Secure the Path Toward Eventual Plan Termination | 11.2022

Ethan Bronsnick, Managing Director, Head of US Pension Risk Transfer at Corebridge Financial discusses where Corebridge focuses its PRT efforts, what PRT developments surprise him the most, as well as his view on what makes PRT attractive in the current environment. Ethan also provides his perspective on why buy-ins are increasingly being used by plan sponsors on their path to eventual plan termination.

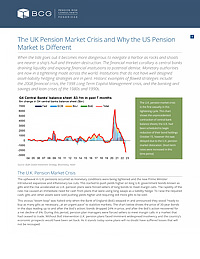

The UK Pension Market Crisis and Why the US Pension Market Is Different | 10.2022

When the tide goes out it becomes more dangerous to navigate a harbor as rocks and shoals are nearer a ship’s hull and threaten destruction. The financial market corollary is central banks draining liquidity and exposing financial institutions to potential demise. Monetary authorities are now in a tightening mode across the world. Institutions that do not have well designed asset-liability hedging strategies are in peril. Historic examples of flawed strategies include: the 2008 financial crisis, the 1998 Long Term Capital Management crisis, and the banking and savings and loan crises of the 1980s and 1990s. This paper describes UK pension plans use of leverage and how they became an early casualty in the current round of global monetary tightening. We also highlight key differences between UK and US pension markets and why it is critical during this period of Fed tightening/market volatility for plan sponsors and their advisors to continually be on the watch for attractive annuity pricing opportunities.

Q&A with Prudential: A Pension Risk Transfer Market Update with an Industry Pioneer | 09.2022

Glenn O’Brien, U.S. Market Leader, Head of Risk Transfer & Guarantee Products Distribution at Prudential provides his perspective on the current state of the U.S. PRT market, including latest trends, the balancing act of pricing and fiduciary considerations, pitfalls to avoid, and key considerations for plan sponsors and fiduciaries as the PRT market is now in its second decade of transformational growth.

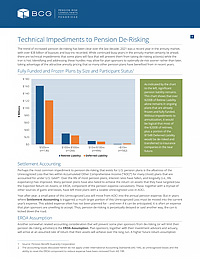

Technical Impediments to Pension De-Risking | 08.2022

The trend of increased pension de-risking has been clear over the last decade. 2021 was a record year in the annuity market, with over $38 billion of buyouts and buy-ins recorded. While continued busy years in the annuity market certainly lie ahead, there are technical impediments that some plans will face that will prevent them from taking de-risking action(s) while the iron is hot. Identifying and addressing these hurdles may allow for plan sponsors to optimally de-risk sooner rather than later, taking advantage of the attractive annuity pricing that so many other pension plans have benefited from in recent years. This paper identifies accounting considerations that may prevent pension plan sponsors from de-risking, and discusses steps to begin addressing these barriers.

Pension De-Risking – The Time for Plan Sponsor Action Is Now | 07.2022

A BCG special feature article in collaboration with BofA Global Research.

Defined benefit pension funds have always been an important source of demand for the bond markets (i.e., Treasury and Investment Grade Credit markets). With recent increases in Treasury rates and widening of investment grade corporate spreads, many DB plans are now at or near being fully funded. With the risk of recession on the horizon, and simultaneously falling Treasury rates, the time for plan sponsor action is now. In this article BCG in collaboration with BofA Global Research attempt to quantify what expected de-risking will mean for demand for Treasury and Investment Grade Credit bonds from both long duration/LDI and PRT strategies.

Tips for a CFO’s Better Night’s Sleep | 06.2022

In the years after the financial crisis of 2008, defined benefit pension plan risks have become a top priority for U.S. corporate pension plan sponsors. Following the financial crisis, plan sponsors diligently worked to reduce balance sheet exposure to pension liabilities through a variety of pension de-risking strategies, including plan redesign (e.g., plan closures or freezes), in-plan strategies such as liability driven investing, and pension risk transfer (“PRT”) strategies such as lump sum offerings and annuity buyouts.

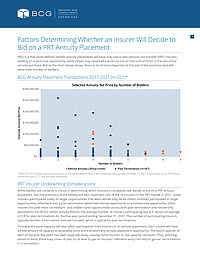

Factors Determining Whether an Insurer Will Decide to Bid on a PRT Annuity Placement | 05.2022

Why is it that some defined benefit annuity placements will have only one or two pension risk transfer (PRT) insurers bidding on a particular opportunity, while others may have half a dozen or more? One critical factor is the size of the annuity purchase. This paper explores the factors, beyond just the size of the purchase, that will determine number of bidders.

Q&A with Groom Law Group: Addressing Alternative Assets in Defined Benefit Plan Terminations – The Legal Perspective | 04.2022

David Levine, Co-Chair, Plan Sponsor Group at Groom Law Group shared how plan terminations have evolved over the years and why proactive attention to wind down strategies for a plan’s alternative investments can often be beneficial.

Rising Interest Rates | 04.2022

The first quarter of 2022 has seen a steep rise in interest rates. This increase in rates is across the board, with increases in short durations as well as long durations, treasuries as well as corporate bonds. While rising interest rates (aka discount rates) generally lead to lower defined benefit pension liabilities, the specific impact on pension liabilities is not necessarily that straightforward.

Q&A with Athene: Pension Plan Funding Has Reached an Inflection Point – Considerations for Larger Plan Sponsors | 02.2022

Richard McEvoy, Senior Vice President and Pension Group Annuity Leader at Athene shared his thoughts on prevalent tailwinds for Pension Risk Transfer and how the market has adapted in recent years to accommodate larger transactions.

A Look Ahead to How the Pension De-Risking Market is Evolving in 2023 and Beyond

More buyouts

- High funding statuses, high interest rates, and competitive pricing are likely to result in another robust year for buyouts

More buy-ins

- All the same reasons apply to buyouts, but buy-ins will be for plan sponsors with settlement accounting concerns, or trying to lock-in annuity pricing at the start (rather than the end) of a plan termination

More lump sums

- High interest rates from the end of 2022, combined with 2022 having been a poor year for lump sum windows, may lead to a fair number of cashout offerings in 2023

More liability driven investing

- Locking in funded status (and reducing volatility) while interest rates are high are likely to be a focus for plan fiduciaries, especially those with frozen plans

Bottom line

- More pension de-risking

A large number of DB plans have a funded status on an accounting basis at or above 100% primarily due to higher interest rates. As a result, we expect 2023 to be a record year for the PRT market as DB plan sponsors continue down their pension de-risking glidepaths or journeys – striking while the iron’s hot.

If along the way, you have a question about your pension plan and need an expert’s unbiased perspective, you can “Ask BCG” here – bcgpension.com/contact

A Big Thank You

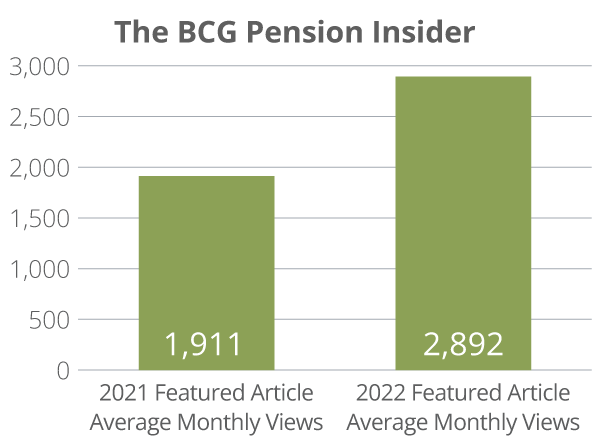

Our efforts beginning in 2021 to author and publish our own BCG branded thought leadership to address topics relevant to the U.S. pension de-risking market, leveraging BCG’s leadership position to share its insights and perspectives, as well as those of other pension industry experts has delivered results.

In 2022, the articles featured in this Roundup have been viewed in BCG’s newsletter that we distribute via email and on social media over 35,000 times, averaging 2,900 views per month in 2022, up from an average of 1,900 views per month in 2021.

Our viewers are comprised of plan sponsors, plan advisors, consulting actuaries, institutional investment consultants, asset managers, law firms, PRT insurers, reinsurers, as well as other pension industry participants. For this – we say a big thank you!

Our viewers are comprised of plan sponsors, plan advisors, consulting actuaries, institutional investment consultants, asset managers, law firms, PRT insurers, reinsurers, as well as other pension industry participants. For this – we say a big thank you!

Refer a friend or colleague to sign up to this newsletter, The BCG Pension Insider. All you have to do is pass on this link – bcgpension.com/sign-up

How Can BCG Help

To learn more or drill down further on any of BCG’s covered or “look ahead” topics, please contact us.

Contact Us

Steve Keating, Managing Director

BCG Pension Risk Consultants | BCG Penbridge

T: 203-955-1566

E: skeating@bcgpension.com

LinkedIn

BCG Snapshot

- Founded in 1983

- Senior team averages 27 years’ experience in defined benefit and/or annuity placement market

- Total five-year annuity placement transactions over $3.6 billion

- 12% annuity placement market share by number of transactions for ten-year period ending 12/31/22

- 100% of firm revenue comes from pension risk consulting and comprehensive implementation support

- Pension de-risking market innovator responsible for several industry firsts

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 4.81%

Term Vesteds (duration of 10) – 4.78%

Actives (duration of 15) – 4.74%

Annuity Purchase Rates as of January 1, 2023