The BCG Pension Insider

May 2024 – Volume 151, Edition 1

Pension Risk Transfer Market Entry – Considerations for Insurers

Fourteen insurers have entered the U.S. Pension Risk Transfer market since 2014, bringing the total number of insurance companies active in the PRT market to 21 with more expected to enter soon. Below is a timeline that shows the year of market entry for both Historical PRT Insurers and New Entrant PRT Insurers.

PRT Insurer Market Entry Timeline¹

PRT Insurer Market Entry Required Capabilities

Insurers need the following capabilities to be successful in the PRT business:

- Financial Strength: The Company must be able to meet the standards of DOL IB 95-1 in order to be chosen by plan fiduciaries, who are ultimately responsible for the choice of insurer.

- Investment Capabilities: PRT product profitability is mostly derived from the spread between earned rates on investments and the pricing discount rate, the Company’s investment manager must be able to generate a sufficient risk-adjusted return on its investment portfolio in a capital efficient way.

- Risk Assessment: Every case requires underwriting judgment to evaluate its unique risk characteristics regarding mortality, and for cases with terminated vested lives there are additional underwriting criteria needed for participant options (benefit commencement and form of annuity), and any additional plan benefits.

- Administrative and Operational Capabilities: The Company or an outsourced provider must have the operational elements in place to administer the business efficiently and accurately according to each case’s distinct requirements. Administration quality also has relevance to DOL IB 95-1.

PRT Insurer Sales Since 2011

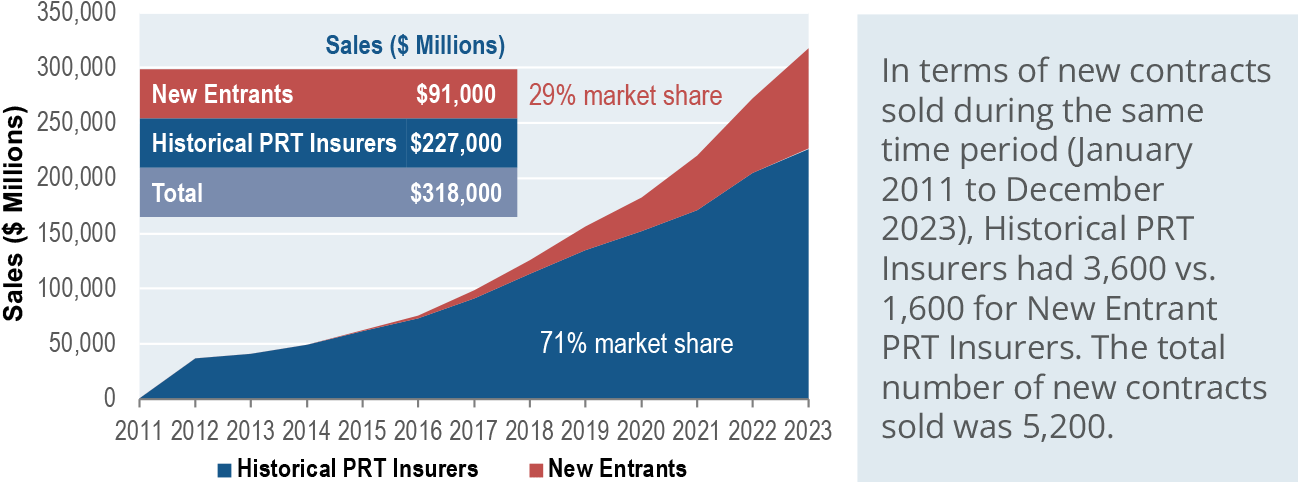

While Historical PRT Insurers continue to be well ahead of New Entrant PRT Insurers in terms of pension group annuity sales, the New Entrant PRT Insurers are gaining ground and actually had higher sales (for the first full calendar year) in 2023. The chart below shows the breakdown of cumulative sales for the period January 2011 through December 2023, rounded to the nearest billion².

Size of U.S. Defined Benefit Market Remains Large

Despite $318 billion in pension group annuity sales since 2011, the size of the defined benefit market remains large. See the table below for PBGC covered plans as of January 1, 2023, the most recent plan year available.

| Number of Plans | Plan Assets ($ Billions) |

PBGC Liability ($ Billions) |

% Hard Frozen | % Retiree |

|---|---|---|---|---|

| 11,046 | $2,148 | $2,191 | 32% | 54% |

* PBGC single-employer covered plans greater than $1 million in plan assets for the period ending 1/1/23.

There are several important takeaways from this 1/1/23 market size snapshot: (1) the defined benefit pension system was approximately fully funded on a PBGC basis, (2) one-third of plans were hard frozen and (3) over half of plan participants were retirees. These figures all pointed towards continued growth of the U.S. PRT market, which we saw in 2023. Additionally, in the YTD 2024 period, continued high interest rates and strong equity markets have resulted in plans being even better funded with the average plan now either fully funded or overfunded on both the PBGC and the PBO accounting basis. This has resulted in less hesitation from plan sponsors to purchase annuities as compared to when rates and funded ratios were lower. Another big year for the PRT market is underway.

Technical Impediments Continue to be a Hurdle for Some Plan Sponsors

Due to Settlement Accounting impact, some plan sponsors continue to focus on short-term accounting expense, despite having a DB plan funded status that would allow for plan termination without any additional contributions in the near term. Another somewhat related accounting consideration that prevents some plan sponsors from de-risking (or limits their pension de-risking activities) is the EROA Assumption. U.S. GAAP accounting rules continue to provide an incentive to remain invested in high risk/high reward investments, by basing pension expense calculation on expected (not actual) investment returns. It will be interesting to see which plan sponsors let this period pass without action³.

On a separate but important note, the uncertain path of Fed actions and interest rates as well as the outcome of the upcoming U.S. presidential election should increase the likelihood that more plan sponsors take action now.

How Can BCG Help

BCG brings a unique level of service to its clients and a much-needed independent perspective. Our dedication and focus on pension risk consulting and PRT implementation provides an integrated, one-stop solution for employers looking to address and manage the risks involved in their pension programs. BCG helps clients with the full range of pension de-risking strategies from LDI approaches to partial or full PRT, with particular expertise navigating the complex and lengthy process of plan termination. BCG also advises insurers on PRT market entry preparedness and reinsurance placements. BCG frequently works in collaboration with plan advisors, consulting actuaries, institutional investment consultants, asset managers and law firms and has established working relationships with all of the insurers that participate in the U.S. PRT industry.

Contact Us

Steve Keating, Managing Director

BCG Pension Risk Consultants | BCG Penbridge

T: 203-955-1566

E: skeating@bcgpension.com

LinkedIn

1 In addition to the new entrants shown, two other insurance companies entered the PRT market since 2014 and have since exited the market. One entered in 2014 and exited in 2016 and the other entered in 2017 and was acquired by another PRT insurer in 2021.

2 Inclusive of annuity buy-outs, which includes retiree lift-outs and plan terminations, and buy-ins.

3 For more information on pension de-risking technical impediments, see BCG’s August 2022 featured article, Technical Impediments to Pension De-Risking, here.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 5.25%

Term Vesteds (duration of 10) – 5.21%

Actives (duration of 15) – 5.06%

Annuity Purchase Rates as of May 1, 2024