The BCG Pension Insider

May 2021 – Volume 115, Edition 1

Pension Risk Transfer Annuity Placement Pricing is Better Than Ever – Will it Last?

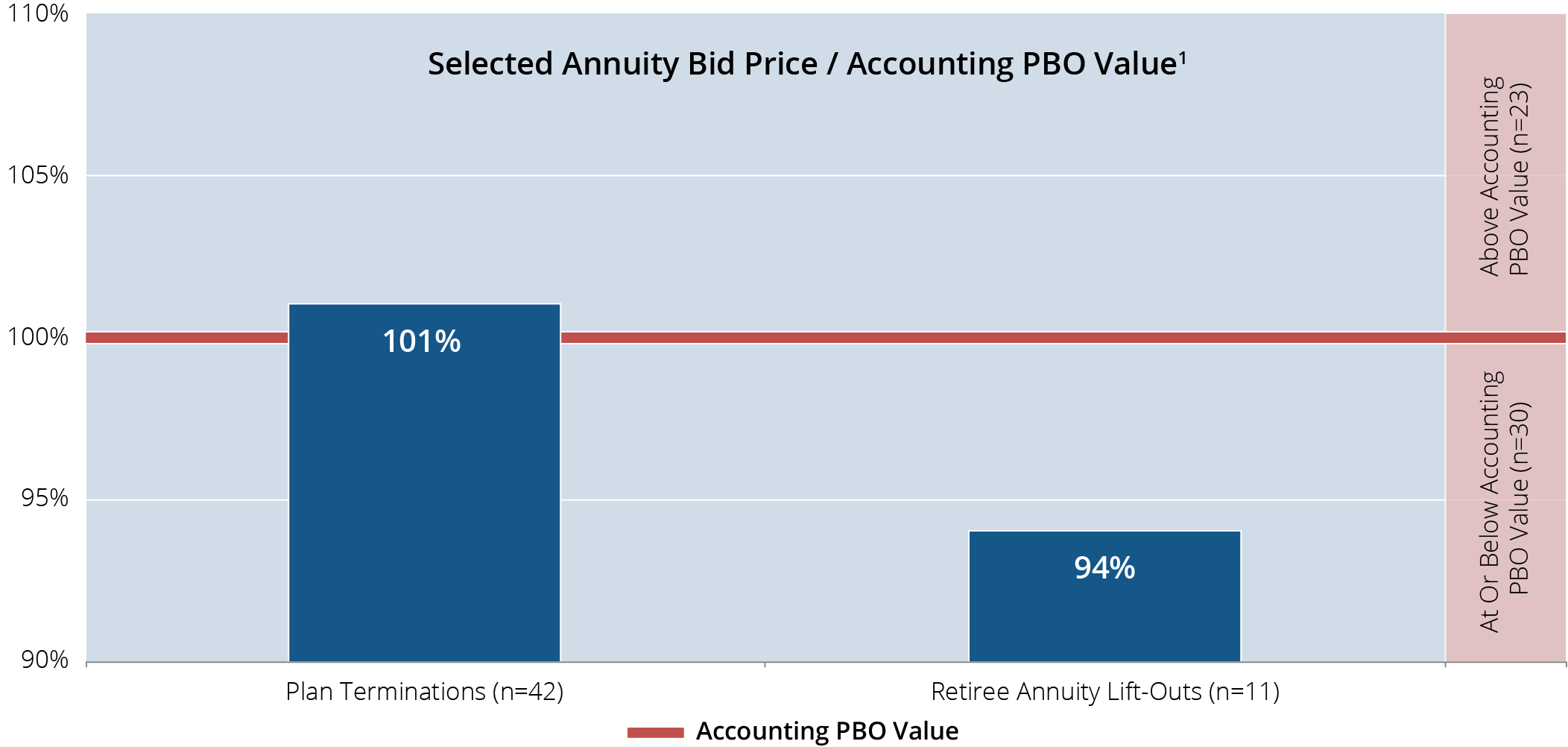

BCG completed a total of 53 annuity placements in 2020, 42 plan terminations and 11 retiree annuity lift-outs totaling over $1 billion in annuity volume. The average selected annuity bid price / accounting PBO value was 101% for the 42 plan terminations and 94% for the 11 retiree annuity lift-outs. These percentages are not typos!

BCG 2020 Annuity Placement Transactions (n=53)*

* BCG has observed similar exceptional pricing on its completed YTD 2021 annuity placement transactions.

Three Factors Currently Contributing to Exceptional Annuity Pricing

- With ten insurers having entered the PRT market since 2014, we are now up to 18 insurance companies active in the

PRT market, which has resulted in more competition to win deals regardless of the size of the deal

Example: Fidelity & Guaranty and Nationwide are Latest Entrants2 - PRT insurers continue to refine their mortality assumptions and evaluate factors that drive mortality as their respective

PRT blocks of business have grown, leading to a more accurate assessment of mortality risk and better pricing

Example: Some PRT insurers are including 9-digit zip codes of participants in their mortality assessments, which has resulted in better pricing especially on lift-outs of lower benefit retirees - Both new entrants and long-standing PRT insurers are increasingly making use of differentiated investment strategies

for their portfolios backing these liabilities, and also using reinsurance as a means to improve pricing

Example: Some PRT insurers are using more structured assets (e.g., collateralized loan obligations) as alternatives to corporate bonds. A few are also using affiliate or external reinsurers to leverage reinsurers’ investment expertise and risk appetite, as well as any capital/tax advantages to improve competitiveness in PRT pricing3

Key Takeaways

Plan Sponsor Action Items

- Engage an unbiased and experienced pension risk advisor to support strategy setting and formulation of pension de-risking objectives

- Ask annuity placement specialist candidates about their PRT market innovation achievements

- Prioritize cleaning plan data, including thorough death audits and address searches, and finalizing all accrued benefits

- Gather all the information needed to assess pension risk transfer, including beneficiary information and 9-digit zip codes when possible

- Take advantage of currently exceptional annuity pricing while it lasts

How Can BCG Help

BCG helps plan sponsors identify, objectively evaluate and implement strategies to efficiently reduce defined benefit plan cost and risk. We have deep experience in helping clients with the full range of pension de-risking strategies from liability driven investing approaches to partial or full pension risk transfer, including navigating the complex and lengthy process of plan termination. BCG is one of the most active annuity placement specialists in the United States, averaging about one placement per week. Our annuity placement process is designed to drive the lowest price in the annuity market.

- 1 Accounting liabilities were calculated using the FTSE Pension Discount Curve for the end of month prior to (or coincident with) the date of annuity placement.

- 2 See February 2021 BCG Pension Insider Newsletter Article – “Major Insurers Flock to U.S. Pension Risk Transfer Market” for more information.

- 3 Reinsurers (when partnering with direct writers on new business opportunities) are typically not subject to DOL IB 95-1 since the annuity contract is written with the direct writer.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 2.05%

Term Vesteds (duration of 10) – 2.31%

Actives (duration of 15) – 2.46%

Annuity Purchase Rates as of May 1, 2021