The BCG Pension Insider

September 2020 – Volume 107, Edition 1

DB Plan Terminations 101

You’ve made the decision to terminate your defined benefit (DB) pension plan. You’ve been told that the process could take a year or more. But what exactly does that process consist of? Here’s your primer on the plan termination process.

Kicking it off

First, get agreement from the decision makers that you want to move forward. This may involve a Board meeting and resolution, and a plan amendment. The plan amendment will identify a “Date of Plan Termination”, or DOPT. While not much will actually happen on this DOPT, it is a line in the sand, which officially starts the process of plan termination. It may be prudent to involve all consultants at this stage (actuary, ERISA counsel, administrator, annuity placement specialist, etc.), as changes to the plan generally cannot be made after the DOPT.

60-90 days before the DOPT, all plan participants must receive a notice that the plan sponsor intends to terminate the plan. This Notice of Intent to Terminate (or NOIT) does not contain participant-specific information, so the same notice will go to every participant, making this a fairly straightforward mailing.

File with the IRS or Not?

The next step will play a huge factor in determining how long the plan termination will take. The sponsor must decide if it will apply to the IRS for a Determination Letter (“DL”). If a DL is sought, another notice must be sent to “interested parties” 10-24 days before filing with the IRS. Interested parties include all participants, as well as other employees of the sponsor working at the same location as participants. Again, this notice (the Notice to Interested Parties, or NTIP) is also fairly straightforward, although the IRS form to file for a DL (Form 5310, and other related forms) can be time consuming, and is typically completed with help from the plan’s ERISA counsel and/or actuary. Obtaining a DL is optional, and ERISA counsel may have an opinion of the value gained by receiving a DL. It can take 6 months or more for the DL to be issued, and it is not unheard of for this to take over a year.

PBGC Filing

Next up is another notice to participants, the Notice of Plan Benefits (“NOPB”). Preparing this notice can be the most time-consuming part of the termination process. These notices are participant-specific. In addition to some generic information about the plan itself and the termination process, the NOPB will contain the details of the participant’s benefit. For non-retired participants, this includes the components of the benefit amount (e.g. salary, years of service, etc.). Once this notice has been sent, the plan can file the Form 500 with the PBGC. This form must be sent within 180 days of the official DOPT.

Waiting

Then you wait. You cannot make plan termination payments until at least 60 days after the PBGC has received the Form 500. The PBGC will send an acknowledgement upon receipt. If the PBGC does not reach out to tell you otherwise, you may then begin distributions 60 days after the PBGC received the Form 500.

Now another decision may await. While the 60 day waiting period may be up, you likely will not have received the DL from the IRS yet (if you filed for it). A plan sponsor must decide if it wants to continue to wait for the DL, or make payments in lieu of the DL. This may be a critical decision as the plan year draws near, as turning the page into a new plan year may mean new interest rates to be used for lump sum payments, as well as another year of government filings (e.g. Form 5500).

Making Payments

All benefits generally must be paid within 180 days of the end of the PBCG’s 60-day review period (usually 240 days after Form 500 received by PBGC). If later, benefits can be delayed until 120 days after receipt of the DL, if the plan sponsor filed for the DL prior to filing the Form 500. If needed, extensions can be sought, and are typically granted. So what benefits are to be paid? Usually, non-retired participants will be offered a choice of a lump sum. Sometimes this offer is made to retirees as well. Those who do not elect to receive the lump sum (or who do not respond to the offer) must have an annuity purchased for them. The offer of the lump sum to participants can take 6 weeks or more, as participants usually receive 30-45 days (or more) to make their choice. The process of purchasing an annuity can be completed in under a month, though typically may take 4-6 weeks. An experienced annuity broker/consultant can be invaluable in securing the annuity from the safest insurer(s), and for the best possible cost. Importantly, participants must receive a notice 45 days in advance of an annuity purchase letting them know which insurers will be considered for the purchase. This is a generic notice (not participant-specific) that is most often combined with one of the earlier participant mailings.

Final PBGC Filing and Audit

Finally, once everyone has either been paid a lump sum, or had an annuity purchased for them, a Form 501 must be filed with the PBGC, essentially reconciling participant counts and liabilities to the previously filed Form 500. This is due within 30 days of the final participant payment, although there is no late-filing penalty as long as it is filed within 90 days of the final payment. If you have any participants that could not be located after a diligent search, they can be turned over to the PBGC at this stage (if you didn’t purchase an annuity for them, Form MP-100 can be used for this). Within 3-4 months, you should hear from the PBGC about a post-termination audit (for randomly chosen plans of under 300 participants, or all plans of 300+ participants). If you have assets leftover at this stage, excise taxes may be owed, depending on what will be done with the excess assets.

A standard plan termination is a long and involved process. Most of the steps and timelines are very well established. Involving the right partners and consultants before the decision to terminate can help to make the termination run as smoothly as possible. There are certainly additional details not mentioned herein, but if you are unfamiliar with the process, this can serve as a high-level overview of what to expect.

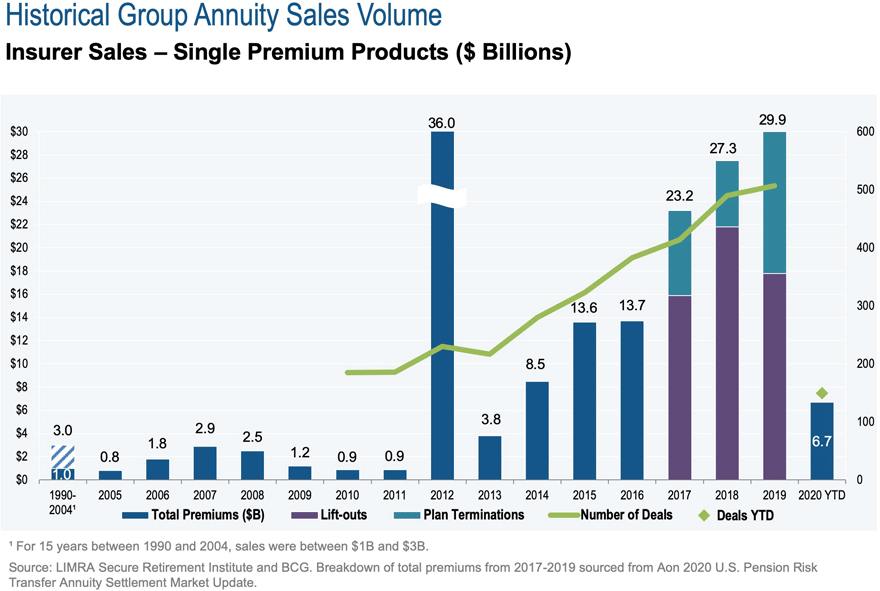

US Annuity Buy-Out Sales Through the Years

Historically, from 1990 through 2011, the total US annuity buyout market size was $1B-$3B annually, with the median size of a deal between $5 and $10 million (150-200 deals per annum). There were few deals over $100M and deals over $200M were very rare. This type of business flow grew steadily from 2012 to 2014 where there were 230, 217 and 280 deals respectively. What changed dramatically during this period was that there were some deals done that were much larger than any that were done before. In 2012, we had the $25B GM deal and $7.5B Verizon deal, but otherwise the market wasn't that different [total sales $36B]. In 2013, the market slowed a bit but there was still increased activity as compared to the years prior to 2012. In 2014 we had $3.1B Motorola Solutions and $1.4B Bristol Myers and the total market was about $8.6B. The median size deal was still no bigger than $10M. From 2015 through June 30, 2020, we have seen more all retiree deals, with emphasis around deals targeting retirees with small benefits. This is based on plan sponsors looking to reduce the cost of maintaining their plans, mostly around lowering PBGC premium and administration expenses. This trend has resulted in more transactions in the PRT market with number of deals ranging from 323 in 2015 to 507 last year. Most deals historically have transacted in the fourth quarter, though in recent years that has started to change where we are now seeing deals spread more evenly throughout the year. Through Q2 of 2020, total sales were $6.7B across 149 deals, with sales and deal activity lower than expected as a result of COVID-19. In the third quarter-to-date period, annuity placements have picked back up as evidenced by many insurers having reached their capacity for September. The remainder of 2020 should be interesting, given insurer appetite for writing PRT business remains strong, though uncertainty surrounding the election could slow down market activity in late October / early November.

ANNUITY PURCHASE RATES

Sample Interest Rates for a Pension Annuity Buyout

(Assumes no lump sums, disability, or unusual provisions)

Retirees (duration of 7) – 1.46%

Term Vesteds (duration of 10) – 1.67%

Actives (duration of 15) – 1.76%

Annuity Purchase Rates as of September 1, 2020